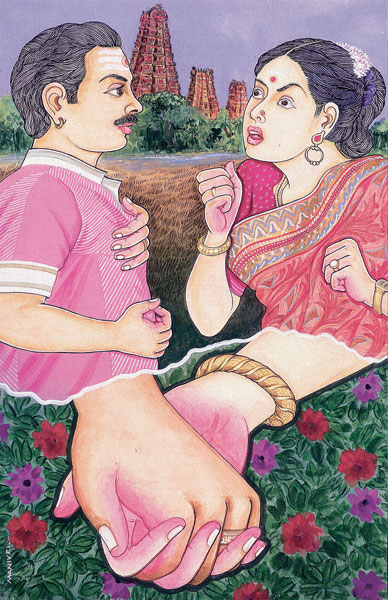

Tale of Two Brothers Shows

Choice of Trustee Is Crucial

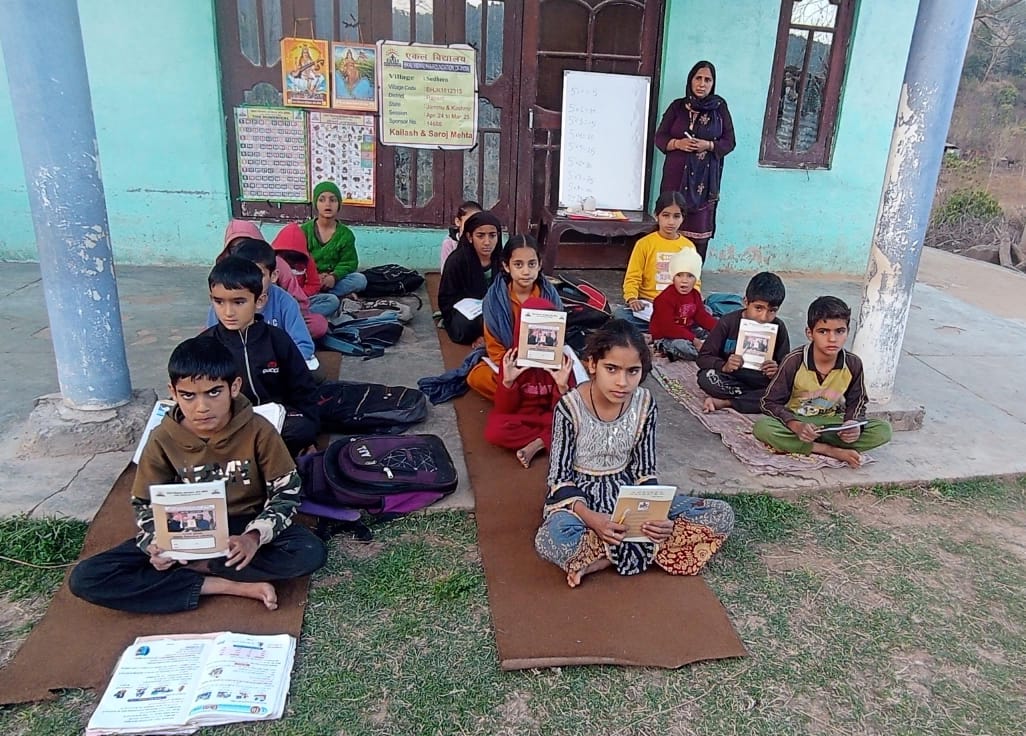

Use care when selecting a trustee for a living trust. Otherwise, contention among family members may arise, as shown here. Choosing a qualified trustee helps ensure harmonious conditions.

Two brothers, never very close, were surprised when their 85-year-old mother called and asked them to meet with her. She would not tell them why. "My friends at the senior center keep telling me I'm crazy not to have a living trust," she told them when they met at her aging Victorian on the edge of town."I want you boys to help me." Amol, a hotel manager in his late fifties, lived just north of San Francisco with his wife. They had two adult children in the area. His much younger brother, Partha, a software engineer, lived alone in San Jose, in Silicon Valley. Amol, to Partha's relief, found a local estate planning attorney. In three weeks the trust was ready for their mother's signature. The two brothers were named successor co-trustees with equal powers. All went well for three years. Then Amol, who visited his mother often, found her one weekend afternoon unable to continue a conversation. The diagnosis at the local emergency room was transient ischemic attack, a temporary lack of blood to the brain. Shortly after they arrived at emergency, his mother was fully alert and clamoring to go home. But they spent the next five hours waiting for tests and the doctor's report. The doctor could find nothing specific, but insisted on overnight observation. The mother, discharged the next day, left fuming at being kept from her home when she had felt "perfectly fine." When Amol told Partha of the incident that afternoon, Partha asked pointedly why he hadn't been called right away. "You've kept your distance for the last twenty years, and now you want me to be your personal eye-witness news team?" Amol shot back. So it went for four more years as their mother continued to suffer fainting spells and diminished capacity. Partha regularly second-guessed his brother's decisions. Amol grew resentful of the time his mother required of him as the nearby son. Then one of Amol's children began taking what Partha thought was an unseemly interest in the value of his grandmother's estate. The damage to already tenuous family relationships was substantial. So far, the brothers have avoided taking each other to court, but just barely. Amol and Partha's story, though fictional, is a composite of true stories. Despite situations like these, estate planning attorneys continue to promote living trusts because they work so well in most cases, allowing families to handle major assets without court intervention and bypassing probate. But many living-trust boosters have tempered their enthusiasm by emphasizing the need for great care when selecting a successor trustee. Having the love of a parent is not the sole qualification. Trustees need to have the competence to manage assets, the discipline not to consider property in a trust as theirs, the ability to cooperate with others, and the self-control to exercise fairness, honesty, respect, courtesy and good faith at times of great stress. No matter how well written your living trust is, the choice of your successor trustee remains crucial to its fulfillment. The Hindu Heritage Endowment wants you to succeed in your estate planning efforts and, through them, both care for your family and remember good causes like the Iraivan Temple Endowment. We've placed a brief trustee code of ethics on our website which you may review at http://www.hheonline.org/trustee_ethics.shtml, or contact Shanmuganathaswami at 808-822-3012 or write to hhe@hindu.org to receive it by e-mail. MISSION STATEMENTHindu Heritage Endowment is a publicly supported, charitable organization recognized as tax exempt by the IRS on April 22, 1994. Employer ID 99-0308924. Founded by Satguru Sivaya Subramuniyaswami, its philanthropic mission is to provide secure, professionally managed financial support for institutions and religious leaders of all lineages of Sanatana Dharma. PROFESSIONAL ADVISORSHalbert/Hargrove, Investment Counsel; Sonoda & Isara, LLP, CPA. HHE is a member of the Council on Foundations, an association of more than 2,000 foundations which interprets relevant law and management and investment principles, and of the National Committee on Planned Giving, the voice and professional resource for the gift planning community. I want to participate. Where should I Send My Donation? You may send your gift to an existing fund, create a new Endowment or request information through the address below. Donations may be made online at www.hheonline.org or use the HHE tear-out card in the HINDUISM TODAY magazine to join our family of benefactors who are Strengthening Hinduism Worldwide. Thank you. |

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs