Halbert Hargrove

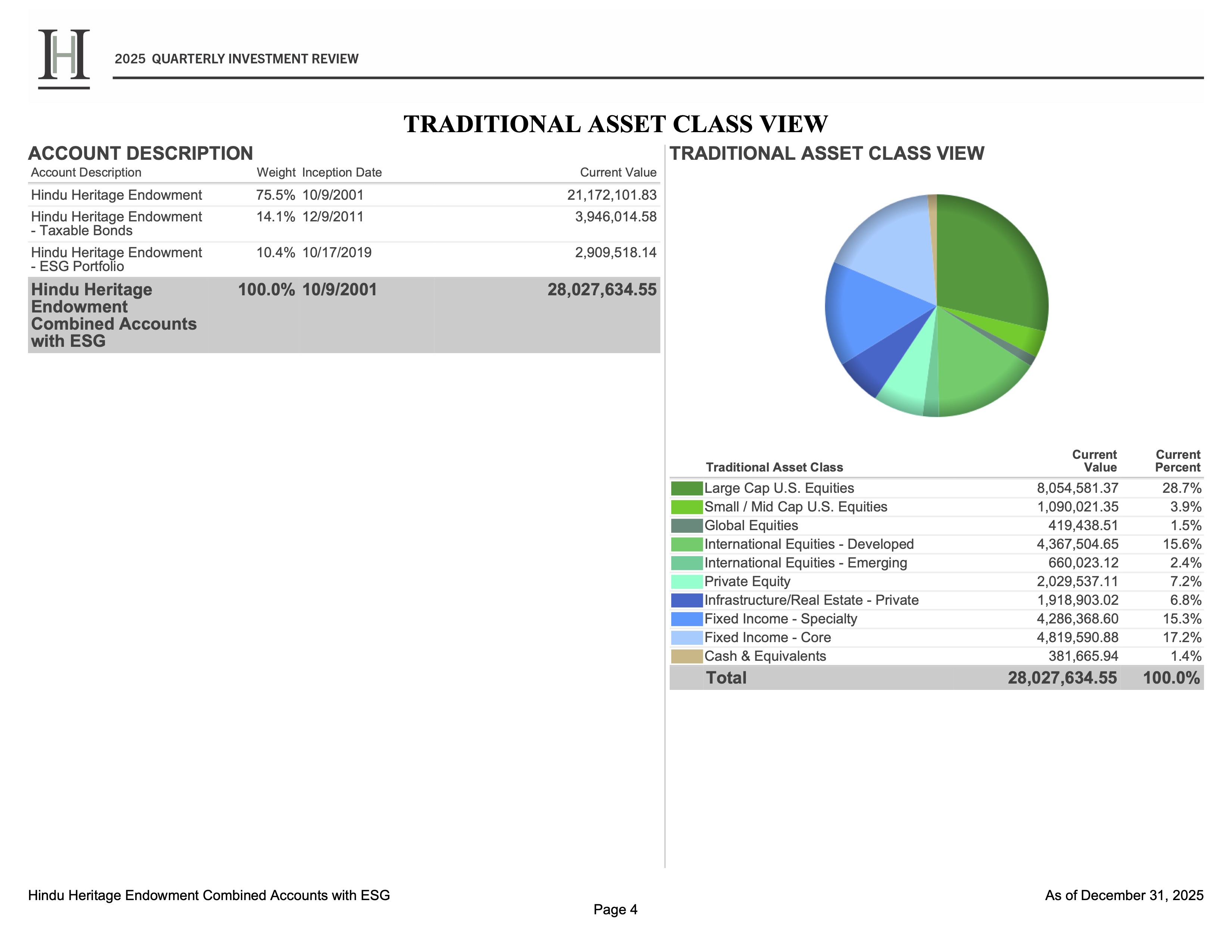

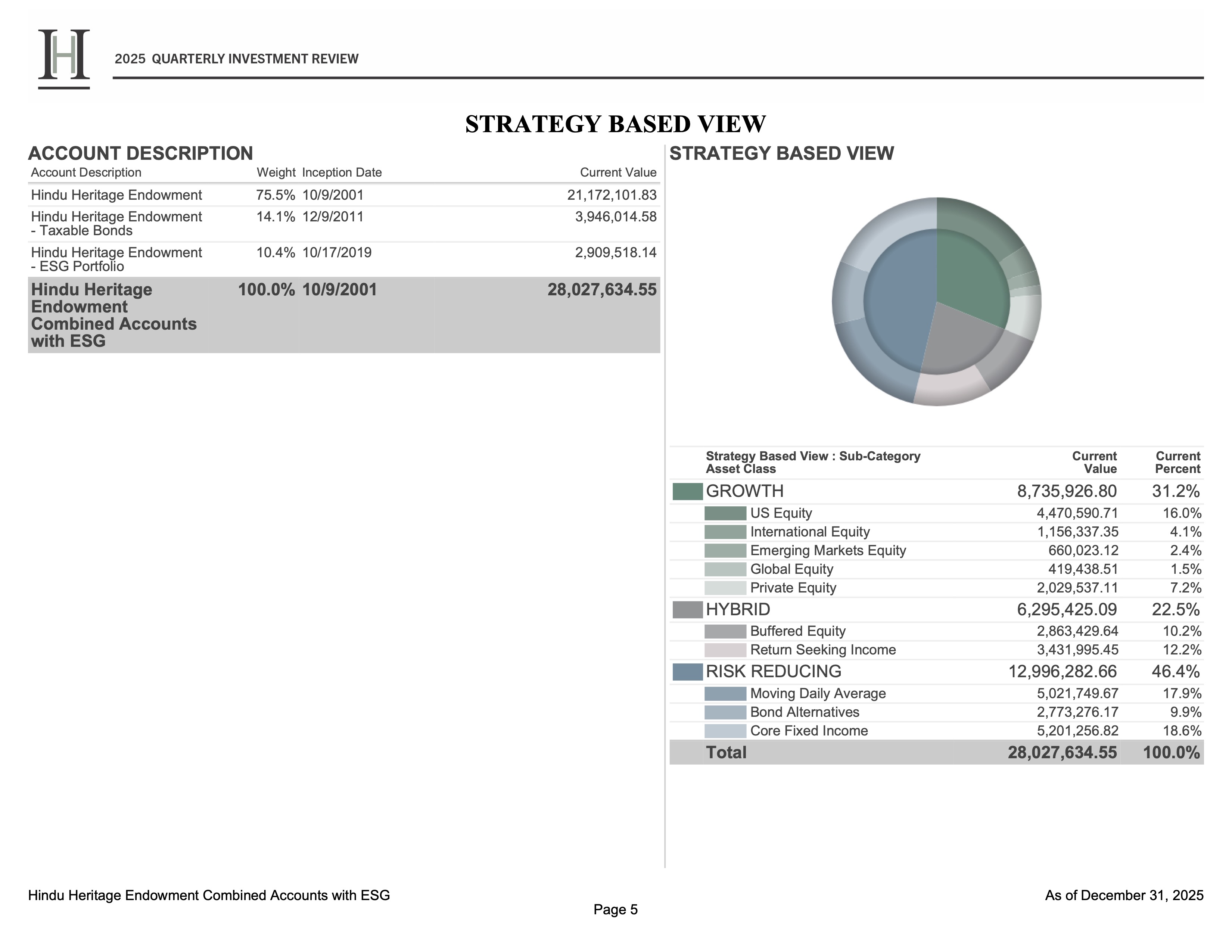

In January, 2011, the Centre for Fiduciary Excellence, LLC, in Toronto, Ontario, Canada, certified Halbert Hargrove to the standard described in the handbook "Prudent Practices for Investment Advisors." Halbert Hargrove is among the first Investment Advisors globally to successfully complete the independent certification process.  Russ Hill: Executive Chairman Halbert Hargrove MBA Stanford The majority of investments are overseen by Halbert Hargrove—a Registered Investment Advisory firm, headquartered in Long Beach, California, focused on providing wealth advisory and investment services to high net worth individuals, foundations, and endowments.  David A. Koch: HHE Fund Councilor Halbert Hargrove are independent wealth advisors and consultants with deep, constructive ties to research, market and technology-driven organizations. Their strategic approach is rooted in an investment philosophy developed through decades of experience in the markets, and in comprehensively managing wealth for institutional and individual clients. Principal Growth by YearAsset Allocation  Investment Returns Compared to A Custom BenchmarkTo understand the investment returns of an endowment such as Hindu Heritage Endowment, it is helpful to compare it to similar investments. Halbert Hargrove has created a custom benchmark for the Hindu Heritage Endowment portfolio that approximates its investment holdings. The benchmark consists of: Bloomberg US Aggregate 33%, NCREIF Property Index 5%, HFRI Fund of Funds Composite Index 18%, MSCI EAFE Net 14%, MSCI EM (Emerging Markets) Net 5%, Russell 1000® 20%, Russell 2000® 5%. Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Year to date 2025 December 31st

|

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs