Community Property and Joint Tenancy: Why it Matters How You Hold Property

A year after they were married, in 1969, Ajit and Inayat bought a home in California. Their realtor suggested they hold it in joint tenancy. That turned out to be bad advice. "It's more convenient," he explained. "When one of you passes on, the survivor gets the decedent's half of the home automatically and without probate." All the young couple remembered was "without probate." Ajit told Inayat that when his unmarried uncle died unexpectedly, the estate was tied up in probate court for a year. He would not want her to be subjected to that kind of delay and expense. Joint tenancy it would be. Shortly after they celebrated their fortieth wedding anniversary, Ajit suddenly passed away. As planned, his widow received his half of the home without the delay or costs of probate. With their children raised and the home too large for her to manage, Inayat put the house on the market for $900,000 and received an offer for the full amount within a week, this for a home they had bought decades earlier for under $50,000. But with the sale came a shock: she had to pay federal and state capital gains taxes on $275,000 of the sale proceeds. "Why?" she asked her realtor. "Because you and Ajit held your home in joint tenancy rather than as community property," he said. "What difference does that make?" she asked, raising her voice. "About $ 65,000 in taxes," he retorted. His answer was curt but the math was correct. Holding their home in joint tenancy meant that when Ajit died, Inayat did not get a full "step-up in basis," a technical term for a financial favor we do our heirs at death. When an heir receives a full step-up in basis, the property he or she receives from us upon our death is viewed by the IRS as though they had bought it at its full fair market value. So if they sell it, they may have little or no capital gains to worry about. If Ajit and Inayat had held their home as community property, Inayat would have avoided being taxed on the $275,000, her realtor explained. "That's not fair!" Inayat moaned. "I know, but it's the law." Though fictional, this tale is based on the many painful experiences of married couples living in community property states. You may have no capital gains to worry about, even if you use joint tenancy. Why? Every home owner has a $250,000 exclusion from capital gains tax when they sell a personal residence, as long as they've lived there at least two years. Married couples can combine their exclusions for a total of $500,000. In certain markets, however, even that may not fully cover the gain. So, if you're married, should you rush out and change title to your home and other assets (rental property and investments held in joint tenancy have no $250,000 exclusion from capital gains tax) from joint tenancy to community property? Not necessarily. Best to first get legal advice and a financial analysis of your situation. Learn more about estate planning and planned giving at www.hheonline.org. |

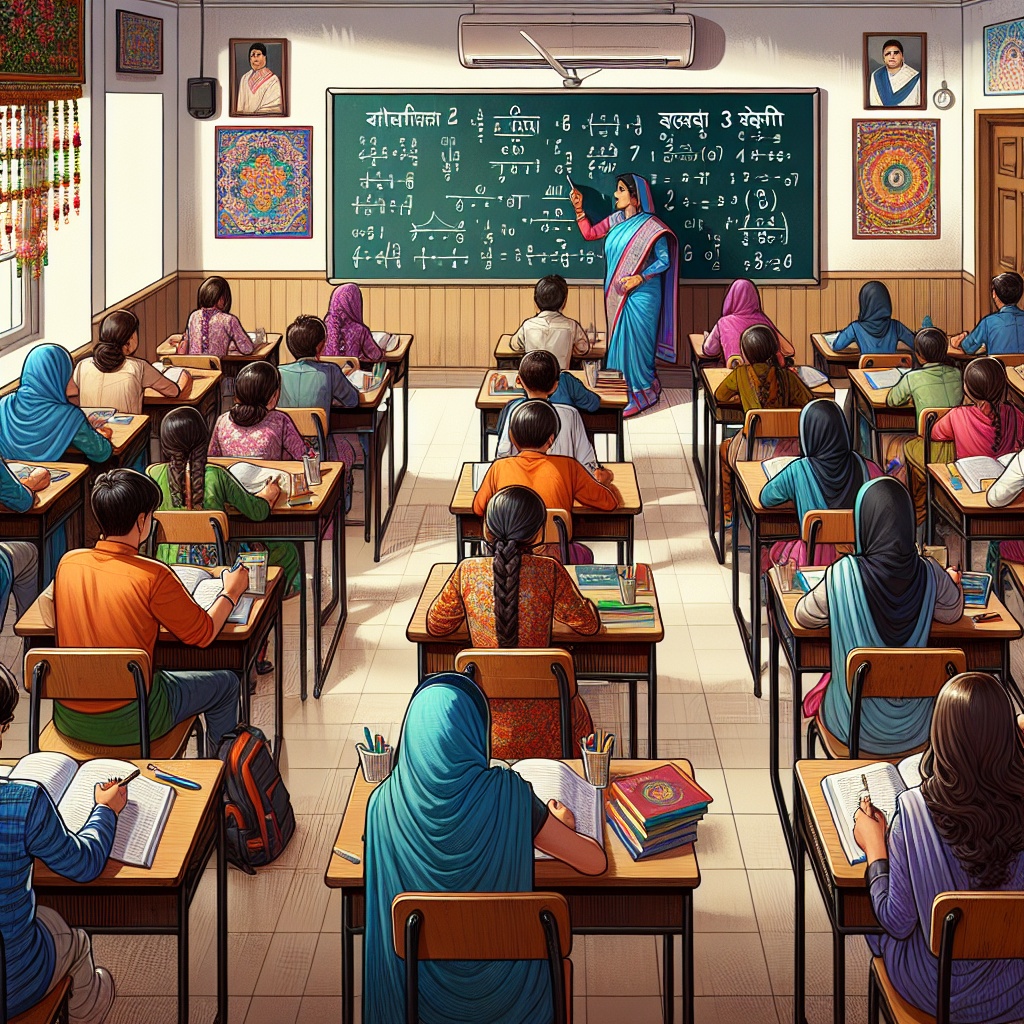

The Hindu Education Endowment

Provide funds to build and operate USA-based Hindu institutes of education

Hindu Association of West Texas Endowment Fund

Provides for the maintenance of this Texas, USA temple

The Himalayan Acres Wildlife Habitat Endowment

Helps maintain the gardens and grounds of this Kauai property

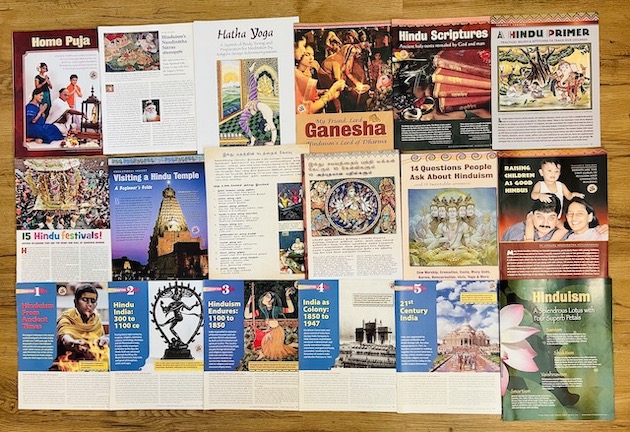

The Himalayan Academy Publications Endowment

Provides funds for the free distribution of printed books and literature of Himalayan Academy