Estate Planning in the United Kingdom You can find out what you need to know about estate planning in the UK at: www.hmrc.gov.uk/index.htm. You can also memorize Shakespeare's 154 sonnets (www.shakespeares-sonnets.com). Both are daunting tasks, especially for Hindu residents adjusting to a culture that uses terms such as "nil rate band" to describe how large an estate has to be before it is subject to inheritance tax: (£325,000 in 2010-11 for a single person, £650,000 for a married couple that has made a proper estate plan). Her Majesty's Revenue and Customs website, where estate planning rules are listed, repeatedly pleads with its readers to "seek legal advice," like an exasperated teacher telling her blank-faced students "it's all in the text." But it's a good place to start. Because so much is at stake, HHE presents a few estate planning basics its UK supporters should know. 1. If your estate is not vulnerable to estate tax, you should still have a will or a trust that determines how you want your estate distributed. Otherwise, the courts will impose an impersonal formula that may or may not reflect your wishes. 2. Married couples need a written estate plan, even though no tax is imposed on the death of the first spouse. Without a plan, large estates may be vulnerable to tax at the death of the second spouse if nothing is done to preserve the estate tax exemption of the first to die. 3. Those who have lost a spouse and then remarried need to provide for children from their first marriage in writing. They should not assume their surviving second spouse will have the same concern for children from their prior marriage. 4. Written estate plans do more than distribute wealth; they can postpone distribution until heirs are capable of managing large sums prudently. They can also provide for heirs with mental or physical disabilities in ways that do not unwittingly jeopardize other benefits their heirs may be receiving. 5. If you own your own business, your estate plan may help you reduce the value transferred of business assets passed to heirs and so reduce possible estate tax. 6. Single people need written plans, otherwise their assets may go to those who don't need them, such as well-to-do parents, rather than to others who do, such as struggling siblings. 7. Unless directed by your written estate plan, the court will ignore good causes you've supported for years and very close friends you want to remember. 8. Your written plan allows you to appoint executors and trustees. Without an estate plan, the court may appoint someone you would never have chosen for these sensitive and demanding roles. 9. The appointment of guardians for bereaved children—among the touchiest of estate planning issues—can be accomplished through a will. You can also specify financial support for the children's maintenance and education. These basic rules only scratch the surface of the tangle of regulations governing estate planning in the UK. What is clear is that the economic meltdown has made written estate plans more urgent than ever. A recent study of 3,000 adult UK residents by the London law firm Seddons showed that one in ten had been recently involved in a dispute following a death. One in five said they feared they would not be treated fairly, and one in four felt they would end up with nothing. Marvin Simons, the head of Dispute Resolutions at Seddons, blamed the rise in disputes on the current economic climate. People are "so much more concerned about money and property values being so depressed, [it] is only likely to result in an escalation of these problems." HHE encourages estate planning, but not just for tax and economic reasons. For Hindus in the UK and elsewhere, estate planning documents are instruments of family peace. And what Shakespeare wrote of Sonnet 18 can be applied to your written estate plan: "So long as men can breathe or eyes can see/ So long lives this, and this gives life to thee." To request a printed copy or a PDF file of the estate planning toolkit, email hhe@hindu.org. Visit www.hheonline.org for more estate planning information. |

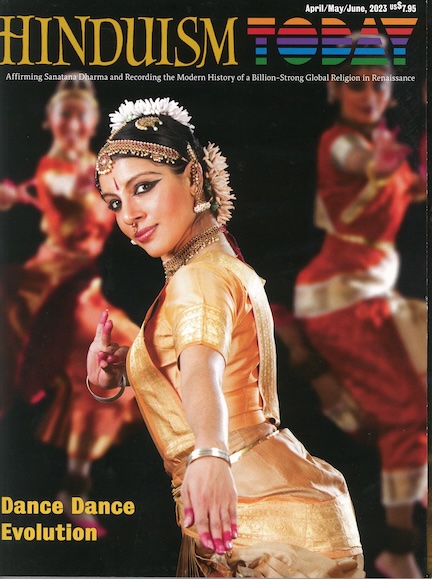

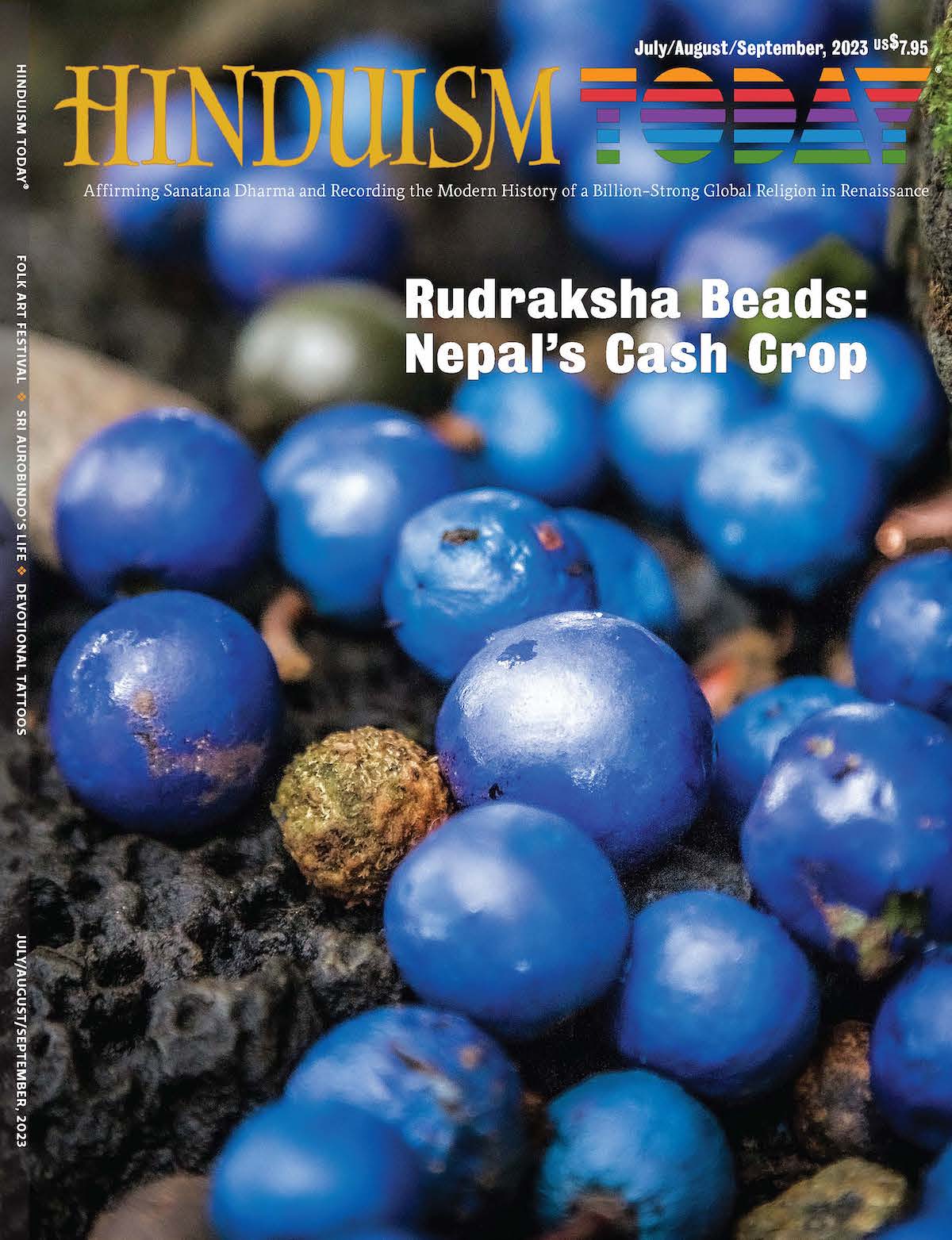

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs