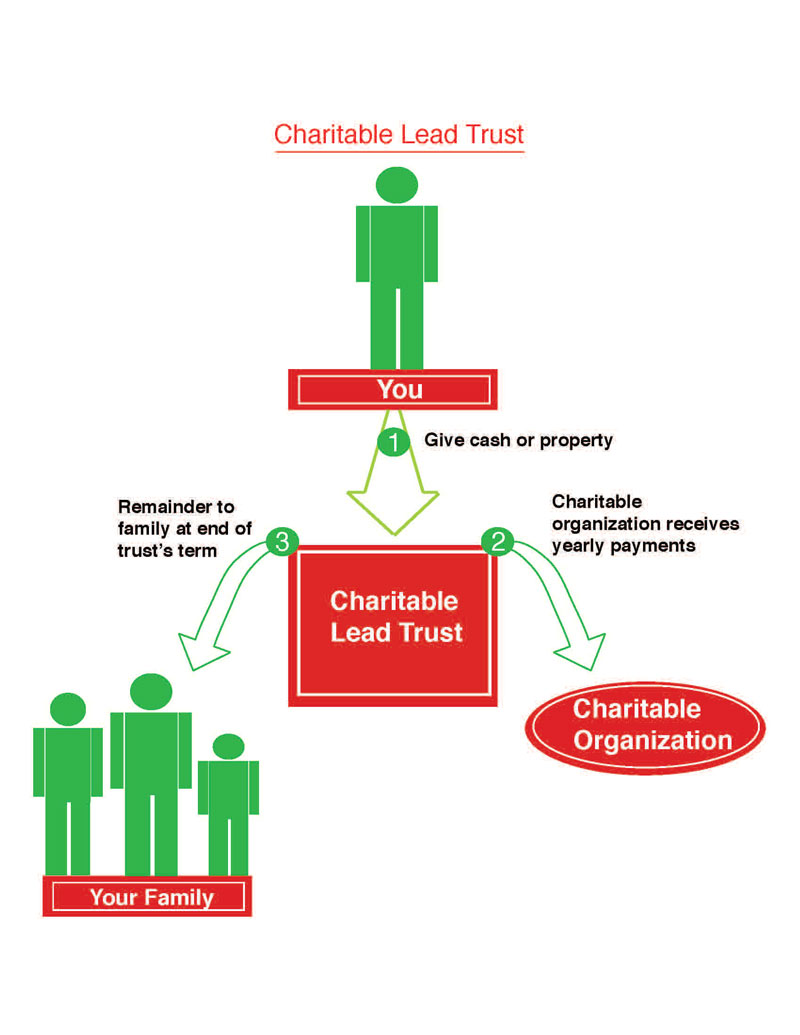

The Charitable Lead Trust---A Flow of Gifts to the Temple and a Legacy Gift to Your Family

Yash has received a generous inheritance from his parents and wants to provide future gifts to his son, Darpan, when he is old enough to manage money responsibly. He also wants to support the construction of Iraivan Temple now. Is there any way for him to meet these two seemingly irreconcilable goals? Yash put this problem to his accountant brother-in-law, Smaran, on the weekend while helping him move some furniture into his new home. After struggling with a queen-size box spring which they finally got to the second floor bedroom, the two men took a break. "Have you considered a charitable lead trust?" his brother-in-law asked. "What in the world is that?" "Let me explain," Smaran aid. "Let's start with your goals. As I understand them, you want to give Darpan about $100,000 when he's 35. Is that right?" "Support a charitable organization while giving to your family, with a Charitable Lead Trust.""Yes. I feel he'll be able to handle money by then. He's only twenty now." "But you also said you wanted to support the Iraivan Temple beginning this year." "That's right," Yash answered. "Here's what you can do," Smaran voluntered. "You place $100,000 into an irrevocable charitable lead trust. You write the trust so that it must pay $4,000 a year for 15 years to support the temple. After that, the trust passes what remains in the fund to Darpan." "Why would I go to all that trouble?" "Here's why. First, you've set up an instrument that provides steady support to the temple. The temple will get $4,000 a year from the trust almost automatically." "That would be great." "Second, Darpan will get about $100,000 tax-free in fifteen years." "Do you think the trust can earn 4% a year?" "Sure," said Smaran. "I know of some tax-free muni bonds that pay 4%. Third, you also get a $47,000 gift tax deduction. I don't know if that helps you much or not, but it limits the damage that the gift to Darpan would otherwise do to your estate tax exclusion." "Well, estate tax is not likely going to be a problem for me," Yash said. "My main purpose is to make sure Darpan gets the $100,000, but not before he's old enough to handle it, and that the temple gets my support starting now." "Then talk to your accountant about setting up a charitable lead trust." For additional information contact Shan�muga�natha�swami at 808-822-3012, ext. 6 or e-mail hhe@hindu.org. To learn more about planned giving options to provide immediate tax and income benefits to you and your family, while also providing a future gift to the Temple, please visit www.hheonline.org. For an estate planning toolkit Click Here |

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs