|

As of March 16, 1994

This Amended Declaration of Trust is executed by the undersigned Trustees for the purpose of amending and restating the original Declaration of Trust of Hindu Heritage Endowment of December 26, 1993, to further the diverse programs of Hindu Temples as well as other Hindu institutions worldwide that are dedicated to traditional and classical Hindu principles and practices, all in accordance with the terms and conditions of this trust, as follows: The Trustor has granted and transferred to the Trustees the property set forth and referred to in such Schedules or Exhibits that may be attached to this Declaration, from time to time. Such property, together with all other property accepted by the Trustees (which may be from any source and made at any time), herein called the trust estate, shall be held in trust andadministered and distributed as set forth in the following Parts and Articles:: Part 1 Introductory Article 1.1 Parts This Declaration has been prepared in parts, as follows: Part 1 - Introductory Part 2 - Trustee Provisions Part 3 - Trust Beneficiaries Part 4 - Termination or Amendment Part 5 - Additional Trust Provisions Part 6 - General Administrative Provisions Part 7 - Final Article 1.2 Religious Purpose a. This Trust is organized exclusively for religious purposes within the meaning of Section 501(c)(3) of the Internal Revenue Code of 1986 (or the corresponding section of any future United States internal revenue law). Notwithstanding any other provision of this Declaration, the Trust shall not, except to an insubstantial degree, engage in any activities or exercise any powers that are not in furtherance of the purposes of this Trust, and the Trust shall not carry on any other activities not permitted to be carried on (a) by a trust exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code of 1986 or the corresponding provision of any future United States Internal revenue law, or (b) by a trust, contributions to which are deductible under Section 170(c)(2) of the Internal Revenue Code of 1986 or the corresponding provision of any future United States Internal revenue law. b. No substantial part of the activities of this Trust shall consist of carrying on propaganda, or otherwise attempting to influence legislation, and this trust shall not participate in or intervene in (including publishing or distributing statements) any political campaign on behalf of any candidate for public office. c. The property of this trust is irrevocably dedicated to religious purposes, as set forth above. No part of the net earnings of this Trust shall inure to the benefit of its trustees, managers, or to any individual. d. Notwithstanding any other provision of these articles, the Trust shall not carry on any other activities not permitted to be carried on (a) by a Trust exempt from Federal income tax under section 501(c)(3) of the Internal Revenue Code of 1986 (or the corresponding provision of any future United States Internal Revenue law) or (b) by a Trust contributions to which are deductible under section 170(c)(2) of the Internal Revenue Code of 1986 (or corresponding provision of any future United States Internal Revenue law). e. Upon the dissolution of this Trust, assets shall be distributed for one or more exempt purposes within the meaning of section 501(c)(3) of the Internal Revenue Code (or corresponding section of any future tax code), or shall be distributed to the federal government, or to a state or local government, for a public purpose. Any such assets not so disposed of shall be disposed by the Court of Common Pleas of the county in which the principal office of the trust is then located, exclusively for such purposes or to such organization or organizations, as said Court shall determine, which are organized and operated exclusively for such purposes. Article 1.3 Revocation This trust is irrevocable. Article 1.4 Amendments This trust is not subject to amendment except as otherwise specifically provided. Article 1.5 Name The Trustees may use such name, from time to time, as is appropriate to identify the trust. It is contemplated that the initial name will be "Hindu Heritage Endowment," but the Trustees may use any other name that is consistent with the purposes of the Trust, as set forth herein. The Trustees shall cooperate with' the Trustors in adopting a name that facilitates the creation of other trusts with similar purposes, from time to time. End of Part 1 Part 2 Trustee Provisions Article 2.1 Authority of Trustees Trust property shall be held in the name of the Trust. A third party need not require the signatures of all Trustees, but may rely on the certificate of one or more Trustees regarding their authority to exercise any Trustee powers. Article 2.2 Successor Trustees and Co-Trustees a. In the event of the death or inability of any Trustee or Successor Trustee to continue to serve, the office of Trustee shall be held by the remaining or Successor Trustee or Trustees specified herein or in any amendment. Such remaining or Successor Trustee or Trustees shall exercise all trustee powers and have full authority to manage and administer the trust estate, but additional or further Successor Trustees may be appointed as otherwise provided b. If any two physicians, (or any one physician who has attended a Trustee for more than 30 days) should certify that such Trustee is unable to serve, and such Trustee has not otherwise resigned, then such Trustee shall be deemed to be on leave of absence until such Trustee again becomes able to serve and such ability is certified in a similar fashion. During such leave of absence, the office of Trustee shall be held by the other Trustee or Trustees then otherwise serving, or by the designated Successor Trustee or Trustees. If such physician or physicians also certify that a Trustee has no reasonable expectancy of regaining the ability to serve, such certification shall have the same effect as a resignation. c. The signature of any one or more of the persons in the group consisting of the original and Successor Trustees named herein, certifying the name or names of the person or persons then serving as Trustee or Trustees, shall be conclusive evidence of the authority of such Trustee or Trustees as to any person relying thereon. d. For convenience, one or more persons may sign this agreement to indicate their willingness to serve as Successor Trustees, but the absence of any such signature shall have no effect on the validity or existence of the trust, and such Successor may sign this agreement or otherwise accept the duties of a Successor Trustee at any time. Article 2.3 Power to Appoint Successors The Trustees who are serving at any time shall have the authority, except as an order of succession is otherwise provided, to appoint successor Trustees, to serve at such time and subject to such conditions as the Trustees may deem appropriate, including the waiver or requirement of any bond. Such authority may be exercised by an instrument in writing that is duly signed at any time. Unless otherwise specified in the appointment, successor Trustees so appointed shall have the same authority to appoint further successors. Article 2.4 Number of Trustees The number of Trustees shall be four, subject to change as otherwise provided. A vacancy in the number of authorized Trustees shall not prevent the remaining Trustee or Trustees from exercising the powers of the Trustees as provided herein, pending the appointment and acceptance of Successors. Article 2.5 Initial Trustees The following persons shall constitute the initial Trustees: Master Subramuniya Rev. Swami Sivayogam Veylan Rev. Swami Sivasiva Palani Rev. Swami Ananta Ceyon Article 2.6 Successor Trustees The following persons shall serve as successor Trustees, in the following order: Rev. Swami Tirunathan Murugan Rev. Swami Ananda Kumar Rev. Swami Arumugam Katir Rev. Swami Adiyan Murugan Article 2.7 Board of Trustees The Trustees, as a group, may sometimes be referred to as "The Board of Trustees," and the Trustees may use that term for all appropriate purposes. Whenever some action is required of the trust through a Board of Directors, whether by law, agreement, custom, or otherwise, the Board of Trustees may be referred to as the Board of Directors, and shall have all of the powers and authorization normally held by a Board of Directors of a corporation.The Trustees may also appoint Committees and Subcommittees of the Board, fix the authority thereof, and establish procedures to be followed in conducting their affairs, including the authority to delegate such powers as the Trustees deem appropriate. Article 2.8 Management by Co-Trustees At all times that the powers of the Trustee are exercised by Co-Trustees, all such powers, unless specifically provided otherwise as to a specific power of class of powers, shall be exercised by a majority thereof. Article 2.9 Bond Except as otherwise provided in any appointment of a successor Trustee pursuant to the authority specified herein, no Trustee or successor Trustee shall be required to furnish any" bond. However the Trustees may voluntarily elect to be bonded, at the expense of the trust, and a court having appropriate jurisdiction may, upon a determination that such bond is necessary for the protection of one or more interests, require such bond, to the extent reasonably required for such protection. Article 2.10 Trust Manager The Trustees may, from time to time, appoint one or more Trust Managers who shall have such authority as the Trustees may confer from time to time, including the authority to hold, manage, invest, and reinvest trust assets, and enter into agreements for compensation for the services of the Manager. A Trust Manager shall serve at the discretion of the Trustees, and may be removed at any time. The Trustees may, from time to time, appoint a bank or trust company to serve as a Trustee, Manager, Agent, or with any other appropriate title, in such capacity or capacities, and with such powers, duties and responsibilities as may be agreed upon from time to time between such institution and the Trustees. Whether or not such institution serves or acts as a Trustee, its powers, duties, and responsibilities shall be limited to those agreed upon and accepted by such institution, in writing. It shall not be liable or responsible to the trust or to any beneficiary (or any other party) for any acts or omissions except as may be governed by such agreement, notwithstanding any other provisions of this trust that apply to the Trustees generally. It is the purpose of this Article to enable the Trustees to secure the specialized services, expertise, experience, and resources of a responsible institution to assist in accomplishing the purposes of the Trust. For such purposes, such institution may be granted powers, duties, and responsibilities that are broader or narrower, in specific instances, than those applicable to the Trustees generally, provided only that no such powers, duties, or responsibilities may contravene the provisions of Article 1.2 or otherwise cause the loss of the tax exempt status of the trust. Such institutional Trustee or agent shall not be a member of the Board of Trustees as that term is used herein, but may, if otherwise agreed, appoint a representative to attend the meetings of such Board. Article 2.12 Indemnification of Institutional Trustee or Agent The Trustees are authorized and directed to hold harmless and indemnify, and toconfirm such indemnification in a separate written agreement, any institutional Trustee or Agent that agrees to serve pursuant to the provision of the preceding Article from any liability. or detriment that such institution may incur by reason of its status as a Trustee or Agent, except as such liability or detriment is incurred pursuant to the powers, duties, and responsibilities that are accepted by such institution in writing. Article 2.13 Adoption of Rules. The Trustees may, to the extent permitted by law and subject to the limitations otherwise provided in this Declaration, adopt and mend Rules for the conduct of the affairs of the trust, including such provisions as may be contained in the Bylaws of a religious corporation. Such Rules may be referred to as Bylaws or such other term as the Trustees mat select, from time to time. Article 2.14 Indemnification To the fullest extent permitted by law, the trust shall indemnify its Trustees, managers, employees, and other persons described in Section 9246 of the California Corporations Code, including persons formerly occupying any such positions, against all expenses, judgments, frees, settlements, and other ,mounts, actually and reasonably incurred by them in connection with any 'proceeding' as that term is used in that Section, including an action by or in the fight of the trust, by reason of the fact that such person is or was a person described by that Section. Expenses, as used herein, shall include all amounts defined as such in such Section. The Trustees may establish rules of procedure to implement this Article, which is intended to apply, as a minimum, the same principles of indemnification to the trust as would apply to a California religious corporation. A copy of such code section is attached as an Exhibit to this Declaration of Trust. Article 2.15 Singular and Plural Any reference in this Declaration to "Trustee" shall, unless the context otherwise requires, mean all Trustees who are authorized to act. Any reference herein to 'Trustees" shall mean the sole Trustee authorized to act if only one is serving. End of Part 2 Part 3 Trust Beneficiaries Article 3.1 Beneficiaries The purposes of the trust shall be carried out by distributing income, in such amounts as the Trustees deem appropriate from time to time, to or for the use of organizations that are primarily devoted to religious purposes in furtherance of traditional and classical Hindu principles and practices and that qualify as permissible trust beneficiaries under the terms of the trust. Article 3.2 Disbursements of Income and Principal Except as other arrangements may be in effect for the distribution of principal, as directed by specific donors and accepted by the Trustees, the Trustees shall only distribute trust income (excluding realized and unrealized capital gains, which shall be accounted for as principal), unless and to the extent the Trustees determine that certain capital gains, whether realized or unrealized, should be distributed as income to trust beneficiaries. The Trustees shall keep adequate records to permit the separate accounting of income and principal and shall, to the extent reasonably practical, follow generally accepted accounting standards for non-profit organizations in the preparation of the annual report. The Trustees shall determine an appropriate schedule for the timing of distributions, and may use a quarterly schedule until some other schedule is determined to be better suited for trust purposes. The Trustees need not distribute all income in any year, but any income so accumulated shall be held for eventual distribution to one or more qualified beneficiaries. The amount of accumulated income at any time shall not exceed reasonable reserves for operating expenses and for specifically defined trust purposes. To the extent that undistributed capital gains, both realized and unrealized, have not been sufficient for such purposes, accumulated income may include, to the extent practical and consistent with applicable law, a reasonable reserve to compensate or partially compensate for any cumulative reductions in the real values of trust assets from the times of their respective contributions that may be due to inflation. Article 3.3 Qualifications of Trust Beneficiaries To qualify as permissible trust beneficiaries, organizations must satisfy one or more of the following conditions; a. An organization may qualify as a permissible trust beneficiary by being exempt from tax as a church or religious organization under Section 501 (c)(3) of the Internal Revenue Code. b. Any organization throughout the world may qualify as a permissible trust beneficiary provided it is an institution that the Trustees have determined is organized and operated in a manner that provides reasonable assurance that distributions to such organization will be used in furtherance of the purposes of the Trust as set forth in this Declaration, and will not be used in violation of any of the prohibitions set forth in this Trust that apply to any uses of trust assets or trust distributions. Article 3.4 Designation of Trust Beneficiaries by Donors Trust beneficiaries may be specified by donors at the time of making donations to the Trust. The Trustees shall attempt in good faith to honor any designations made by a TrustDonor with respect to the assets contributed by such Donor. However, notwithstanding any contrary Donor designation, all applicable qualifications, as they may exist from time to time, must be met by each beneficiary at all times that such beneficiary is receiving distributions from the Trust. Whenever a designated beneficiary does not meet such qualifications, either initially or in the passage of time, the Trustees shall make the appropriate distribution to one or morealternate qualifying beneficiaries which, in the judgment of the Trustees, are reasonably likely to use the distributions in the manner and for the purposes expected by the Donor, consistent with the stated purposes of the trust. The designation of beneficiaries by Donors may be by name or by such classifications or criteria as the Trustees find appropriate and administratively feasible. Article 3.5 Standards for Donations The Trustees are specifically authorized to set and maintain standards, from time to time, regarding the amounts and types of donations that the Trustees are willing to accept, consistent with economical trust administration and the purposes of the Trust. The Trustees shall not be required to accept any donation that they do not consider appropriate .for any reason. Article 3.6 Selection of Beneficiaries Except as qualifying beneficiaries are designated by Donors, or alternative beneficiaries are selected by the Trustees in accordance with the provisions applicable to designated beneficiaries, the selection of all beneficiaries shall be made by the Trustees, subject to the qualifications required by this trust and such additional qualifications as the Trustees may determine, from time to time, in furtherance of the purposes of the trust. Article 3.7 Endowment Status Funds donated to the trust, subject to reasonable administration expenses, andwhether or not specifically designated as such by Donors, shall be treated as endowments. In keeping with such status, the Trustees shall endeavor to maintain the trust principal of such endowments intact at all times, and only to distribute income. In those instances, however, in which particular funds became uneconomical to administer as endowments, the principal thereof may be distributed to one or more permissible income beneficiaries, and such endowments may terminate. End of Part 3 Part 4 Termination and Amendment Article 4.1 Termination This trust shall continue for such period of time as its purposes may be fulfilled, unless the Trustees determine that good cause exist for its earlier termination. In the event of termination, the remaining trust assets shall be distributed, subject to the requirements set forth in Part 1. Article 4.2 Amendments No amendment of the trust may be made that causes the trust to lose its qualification as a tax exempt organization or that defeats its primary purpose, Subject to such limitations, the Trustees, by majority vote, may amend one or more provisions of the trust, from time to time. No judicial approval of any such amendment shall be required, but the Trustees may petition a court having appropriate jurisdiction for approval of any amendments that the ' Trustees deem proper, from time to time. End of Part 4 Part 5 Additional Trust Provisions Article 5.1 Special Donations, Funds, and Endowments Consistent with the general purposes of the trust, the Trustees may receive additional contributions for certain specific purposes, including endowments, such as the preservation or maintenance of specific temples or shrines, or any other appropriate religious purpose, and may execute such 'agreements with Donors as may be appropriate to confirm the specific purposes for which particular donations will be used.. The Trustees may also establish special purpose funds or endowments and make the terms thereof known to prospective Donors. The Trustees shall, consistent with the purposes of the trust and applicable provisions of this Declaration, hold and distribute donations that are made to such special purpose funds in accordance with their terms. Article 5.2 Tax Advantaged Arrangements The Trustees may, subject to any applicable legal requirements, accept donations to the trust in the form of Pooled Income Funds, Charitable Remainder Annuity Trusts and Unitrusts, Charitable Gift Annuities, Deferred Payment Gift Annuities, and any other arrangements customarily used by charitable organizations to facilitate donations through tax advantaged arrangements. Article 5.3 Investment Principles The Trustees shall, consistently with sound investment objectives, invest trust assets in keeping with the basic purposes of the trust, specifically with a view toward social responsibility in accordance with Hindu ethical principles. Wherever practical and expedient, the Trustees shall attempt to minimize or avoid investments in such industries as alcohol, tobacco, and gambling, and in companies that do not protect animals or the environment, but the Trustees shall not be liable or accountable for any investments that are not in compliance with such restrictions. Article 5.4 Annual Report a. The Trustees shall prepare and distribute, at least annually, a report of the activities of the Trust, which shall include, among such other matters as the Trustees deem appropriate, the following: 1) A beginning and ending balance sheet and income statement; 2) A schedule of endowment funds that includes, for each separate fund, the beginning and ending fund balances, and the activities accounting for the net change during the year. b. The Trustees may select an annual or a fiscal year for purposes of preparing the annual report, and may make appropriate changes in the period selected, from time to time, consistent with trust objectives. c. Each trust beneficiary that has been a beneficiary during the year covered by the report shall receive a schedule showing separately each of the endowment funds to which it is a beneficiary, including the beginning and ending fund balances, and the activities of the fund accounted for during the year. d. Copies of the annual report may be provided to such other person or persons as the Trustees deem appropriate, and may also be furnished to the public, in the discretion of the Trustees. Article 5.5 Investment Management The Trustees shall not, without the advice of one or more professional investment managers, or professional investment advisors, make investment decisions for the trust. The Trustees shall seek to have the current opinion of one or more persons who have a professional status in the field of investments that is appropriate, in depth and frequency, for the size of the trust investments. The Trustees may consider any investment criteria specified by a donor at the time of making donations to the trust, but shall not follow such criteria to the extent that doing so is considered an imprudent investment for the Trustees by their professional advisors. Article 5.6 Publicity and Solicitation The Trustees are authorized to take appropriate action to make the Trust known to individuals and organizations in Hindu religious communities throughout the world and to solicit gifts from such individuals and organizations, as well as any other sources the Trustees deem appropriate. End of Part 5 Part 6 General Administrative Provisions Article 6.1 Administrative Provisions a. General Powers The Trustee shall have the following general administrative powers and such additional powers as may be appropriate to carry out the terms of the trust, including but not limited to those implied or conferred by law: (1) To sell (for cash or in installment payments), convey, exchange, convert, partition, loan, divide, option, improve, repair, maintain, manage, operate, insure, hold, and control trust property; (2) To lease and enter into agreements for the leasing of trust property for terms within or beyond the terms of the trust and for any purpose, including ground leases, and pooling and unitization agreements; (3) To borrow money for any trust purpose and to encumber or hypothecate trust property by mortgage, deed of trust, pledge or otherwise; (4) To compromise, or otherwise adjust, any claim or litigation against or in favor of the trust estate; (5) To commence or defend such litigation or exercise such other legal remedies with respect to the trust estate as may be deemed advisable; (6) To invest and reinvest the trust funds in such property as may be deemed advisable, whether or not of the character permitted by law for the investment of trust funds, and without restriction as to form or diversification; (7) With respect to securities held in trust, to exercise all the rights, powers, and privileges of an owner; to vote, give proxies and pay assessments or other charges, participate in reorganizations, consolidations, mergers and liquidations, and incident thereto, to deposit securities with and transfer title to any protective or other committee upon such terms as may be deemed advisable, and to exercise or sell stock subscription or conversion rights; (8) To carry insurance of such kinds and in such amounts as the Trustee deems advisable, at the expense of the trust, to protect the trust estate and the Trustee personally (9) To receive additional contributions to the trust estate from any sources. b. Distribution in Kind Subject to other applicable provisions, upon any division or distribution of property, the Trustee may divide, allot, or distribute such property in kind, including undivided interests therein, or the Trustee may sell all or any part of such property and make such division or distribution in cash or partly in cash and partly in kind. c. Retention of Assets The Trustee may retain, for such time as may be deemed advisable, any property received hereunder whether or not of the character permitted by law for the investment of trust funds, including shares of stock issued by a corporate Trustee, and continue and operate, at the risk of the trust, any business which the Trustee may acquire hereunder so long as the Trustee may deem it advisable to do so. d. Resignation In the event of the resignation of a Trustee, the powers conferred upon the resigning Trustee may continue to be exercised until their assumption by another Trustee. This provision shall not restrict the right of a Trustee to resign at any time, which may be accomplished by reasonable notice to existing beneficiaries or as otherwise herein provided. e. Actual Notice Unless the Trustee shall have received actual notice of the occurrence of an event, the Trustee shall not be liable for any action taken as though such event had not occurred. f. Release of Powers The Trustee may release or restrict the scope of any power that may be held in connection with the trust estate, whether such power is expressly granted or implied by law. g. Tax Matters The Trustee may make any election allowed by law in connection with the tax liabilities of the trust estate and its beneficiaries, and may allocate the benefits thereof among the various beneficiaries, in such reasonable fashion as the Trustee deems proper. h. Trustee's Fees The Trustee shall be entitled to reasonable compensation for ordinary services, and for any services in connection with the termination of the trust or any share thereof, in whole or in part. i. Physical Division The Trustee may, but need not, make a physical division or segregation of the property of one or more shares, trusts, or interests in the trust estate, but shall keep separate accounts for each separate interest. j. Obligations for Acts of Predecessor No successor Trustee shall be liable for any act, omission, or default of a predecessor Trustee. Unless requested in writing within 60 days of appointment by a beneficiary, no successor Trustee shall have any duty to investigate or review any action of a predecessor Trustee. k. Abandonment The Trustee may abandon any property or interest of the trust estate when the Trustee determines such abandonment to be in the best interests of the trust estate and its beneficiaries. 1. Trustees and Third Parties The Trustee shall exercise all trust powers in a manner that is consistent with the purposes of the trust. However, notwithstanding any other clause or provision of the trust, any persons with whom the Trustee (or any of them if more than one are serving) has any transactions, including buyers, sellers, borrowers, lenders, agents, stock brokers, real estate brokers, transfer agents, title and escrow agents, banks, mutual funds, and any other person or persons with whom a Trustee has any dealings whatever, may rely in good faith on the authority of that Trustee to exercise any power in any manner whatever that such Trustee purports to exercise, whether or not such power is included in or omitted from those powers expressly stated in this instrument. The Trustee shall, at the expense of the trust, hold harmless and defend any such party from any liability that may be alleged by any person by reason of the alleged lack of any power that a Trustee has exercised. Article 6.2 Spendthrift Clause No beneficiary of any trust or share thereof as herein provided shall have any right to alienate, encumber, or hypothecate any interest in the principal or income of the trust in any manner, nor shall such interest of any beneficiary be subject to claims of creditors or liable to attachment, execution, or other process of law. At the time of any distribution to a beneficiary the Trustee shall make such distribution directly to the beneficiary, and the foregoing restrictions and limitations shall apply until physical distribution is completed. End of Part 6 Part 7 Final Article 7.1 Captions The use of captions in describing the terms of the trust are for convenience only. They are not a part hereof, and in no way amplify, limit, or modify any of the terms hereof. Article 7.2 Governing Law This Declaration shall be construed under and be governed by the laws of the place in which the management and affairs of the trust are conducted. Notwithstanding any contrary provisions of the law of such place, however, the Trustees may rely upon and be guided by the provisions of the Uniform Management of Institutional Funds Act as amended from time to time, as to all matters to which such Uniform Act applies. End of Part 7

Hindu Heritage Endowment Amended Declaration of TrustFebruary 19, 2002 |

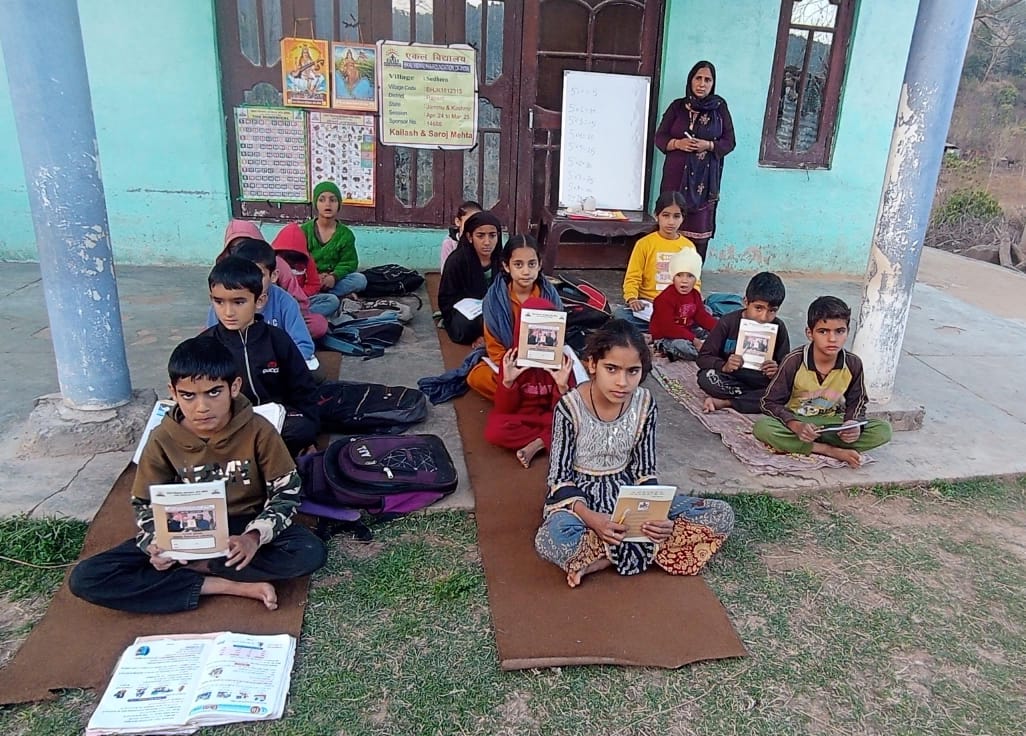

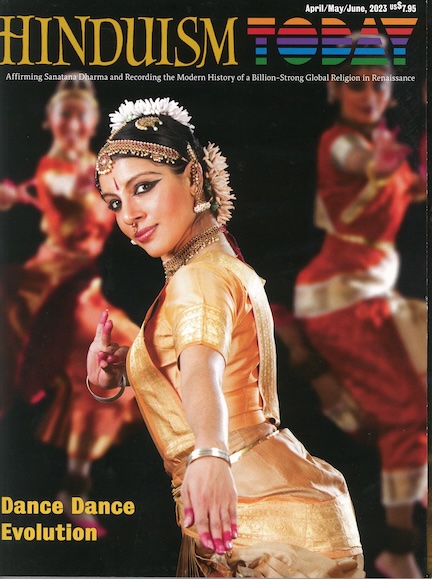

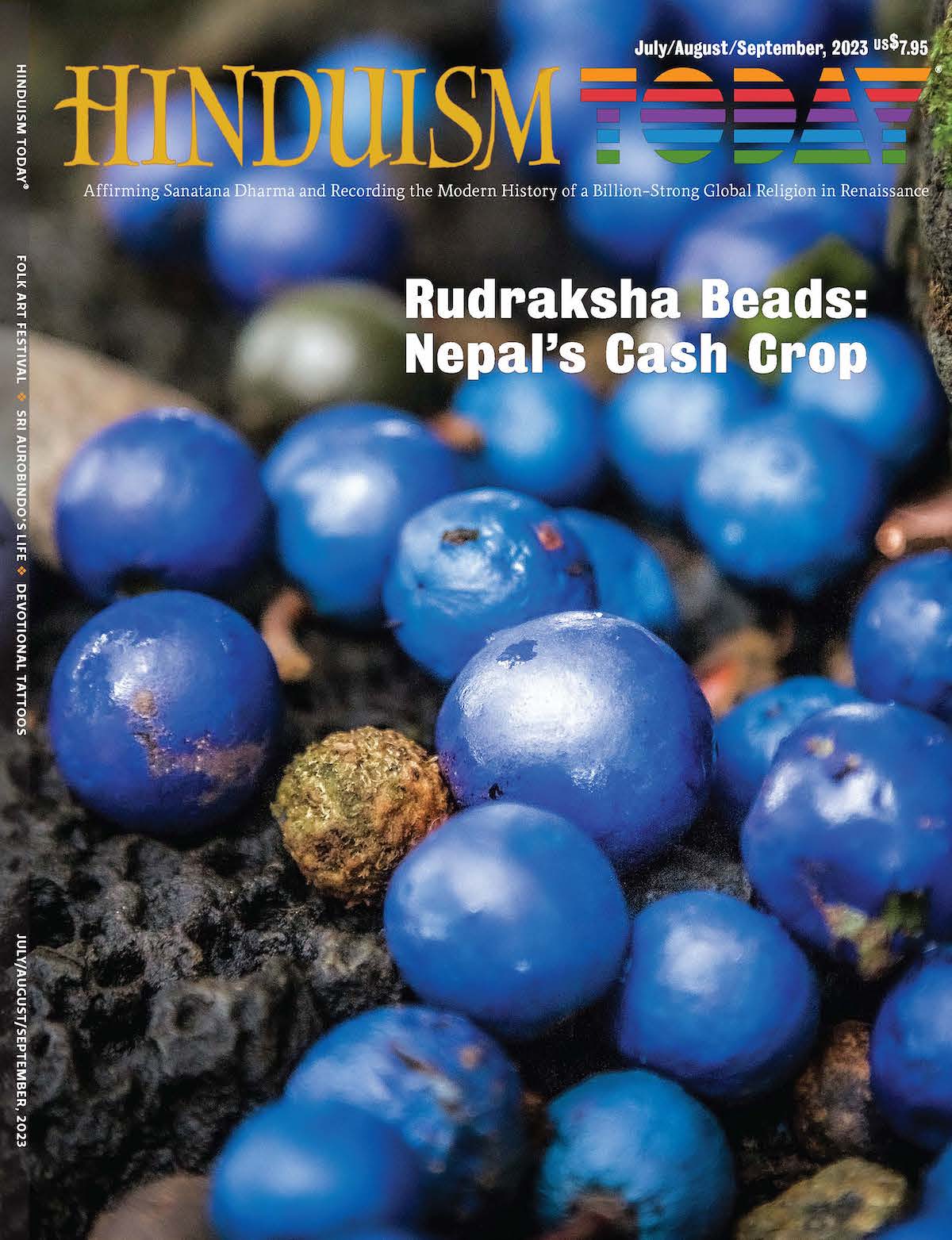

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs