Pooled Income FundSeptember - October 2001There are a number of options for charitable giving other than an outright gift. These options, often referred to as "deferred" giving plans, usually allow the donor to retain the benefit of the donated funds, with a gift to charity at a later date. The advantage of such plans is that the donor can receive an immediate income tax deduction for the value of the donor's gift and can avoid the payment of any capital gains tax on a gift of appreciated property. The simplest, and perhaps most common, form of deferred giving is the pooled income fund (PIF). These funds, established by charities to encourage deferred giving, are usually offered by universities, churches and other major charitable groups. In return for the donor's contribution of cash or property to the PIF, the PIF agrees to provide the donor and/or the donor's spouse (or any two individuals chosen by the donor) with a life income. There is no guarantee of the amount of income, as it is based upon the investment return of the PIF. The PIF will provide the donor with a history of its past investment results, as well as its investment philosophy, to give the donor some idea of the income the donor can expect. At the death of the donor and/or the donor's spouse, the income interest will terminate, and the donor's capital account in the PIF will be given to the sponsoring charity. A PIF has clear tax advantages. The donor will be entitled to an income tax deduction in the year in which the donor makes the donor's contribution to the PIF. The amount of the deduction is the value of the interest which passes to the charity at the donor's death or the death of the donor's spouse. This amount will vary, depending upon the donor's life expectancy and the investment return of the PIF. As an example, if a 60-year old donor transfers $100,000 to a PIF which has a 6.0% return, and retains a life income interest, the amount of his charitable deduction will be $35,033.  There are also advantages to contributing appreciated property, such as stock, to a PIF. Although the stock will be valued at its fair market value in determining the donor's charitable deduction, no capital gains tax will be imposed on the donor or the PIF. A contribution to a PIF will also help to reduce the donor's estate tax, since the amount passing to the charity after the donor's death will be deductible for estate tax purposes. Nitai H. Pathak, CPA, MST, of Kling, Lee & Pathak, CPAs, Cerritos, CA 562-402-8610 . PIF Trusts Hindu Heritage Endowment refers to pooled income funds as PIF trusts and currently offers two PIF trusts to its donors, each with a different mix of stocks and bonds. PIF Trust #1 has an allocation of 80% bonds and 20% stocks and is appropriate for income beneficiaries who are older. PIF Trust #3 has an allocation of 45% bonds and 55% stocks and is appropriate for income beneficiaries who are younger. Both are administrated by First Hawaiian Bank as corporate trustee. HHE has prepared a folder with many examples of instances in which the use of PIF Trusts are appropriate, such as a gift to a new born child or a gift to a newly wed bride or groom. The folder includes a fifteen-page booklet, "The Pooled Income Fund," produced by R&R Newkirk which contains a comprehensive description of this deferred giving option. To receive a copy of the HHE folder on PIF Trusts, simply check the box on the tear-out card requesting information on the pooled income fund and mail it to us or e-mail hhe@hindu.org. As a public service, HHE occasionally will offer the opinions of financial planners. However, it endorses neither these advisors nor their counsel, and recommends that all individuals seek professional advice from several sources before making important long-term decisions. Recent Endowment Contributions |

|

Kauai Aadheenam Monastic Endowment Vinaya Alahan Chandran Nagalingam Total

Iraivan Temple Endowment Prakash Kumar Balasubramanian Paul Yogananda DeSantis Gregg Lien Mogan Ramasamy Haymamanili Subramaniam Niraj Thaker Other Donations Total

Kauai Aadheenam Annual Archana Fund Other Donations

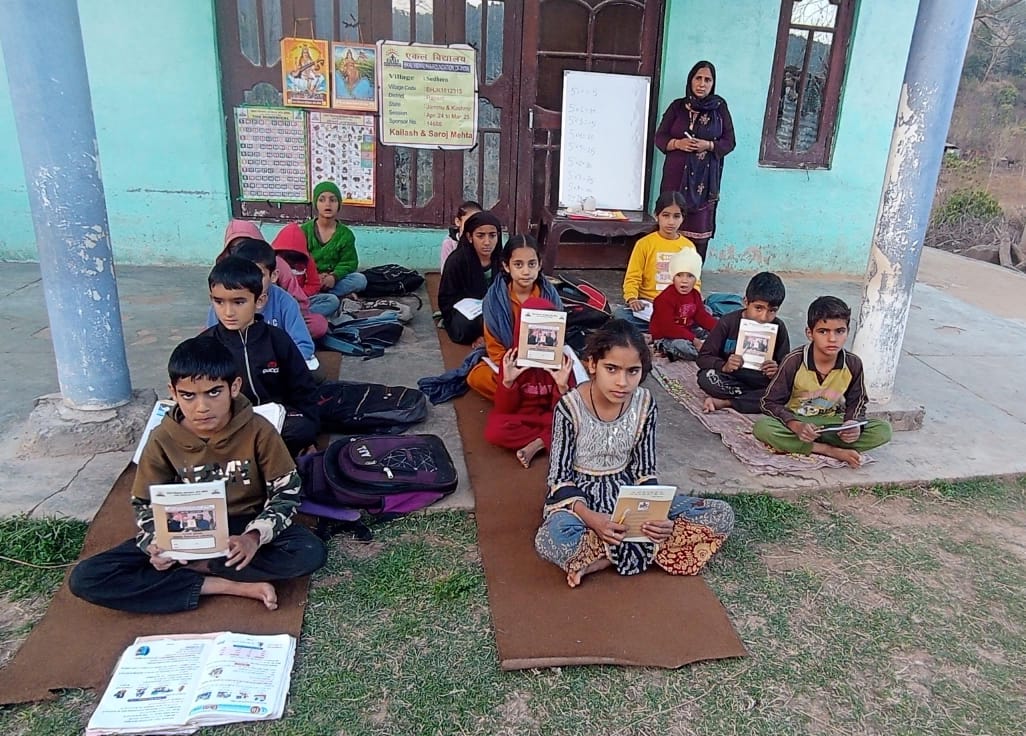

Hinduism Today Distribution Fund Chellappa Deva Balu Devado James Jay Devlin Ravindra Doorgiat Annapoorani Ganesan Chitravelloo Gunasegaran Ramu Govindasamy Tara Barrie-Hull Isanah Kameni Egilen Koothan Amravaddee Kownden Thanesh Kumar Kumaravel Christian Langers Thavamalar Lingam Alistair McElwee Manmohan Mittal Mardaymootoo Mootoosamy Nalakini Niranjana Logadassen Peruman Pakion Vedee Peruman Nishant Lakshmaiah Peruri Parthasaraphi

Rajagopalan Selvaraj Sanjeevee Lavanadevi Sivam Sivadas Sivarajah Guha Skanda Womana Skanda Robert Sorrells Raghu Srinivasan Mahesh Srivastava Ganesammal Supiah K. S. Thamilarasi K.D. & A.D. Williams Per Winther Other Contributions Total

Hindu Businessmen's Association Vel Alahan Paramaseeven Canagasaby Manogaran Mardemootoo Easvan Param Janaka Param Other Contributions Total

Boys School for Iraivan Priesthood Indra Dhaksinamurthi Christian Langers Bala Sivaceyon Total

Mathavasi Medical Fund Gowri Nadason Chandran Nagalingam Vayudeva Varadan Matthew Wieczork Total

Tirunavukkarasu Nayanar Gurukulam James A. Babson Aran Sendan Total

Sri Subramuniya Kottam Indra Dhaksinamurthi Total

Malaysian Hindu Youth Education Chandran Nagalingam

Kumbhalavalai Ganesha Temple Fund James A. Babson Indra Dhaksinamurthi Manoharan Navaratnarajah Total

Hinduism Today Endowment Alistair McElwee

Hindu Orphanage Endowment Ajit S Adhopia Lila Shakti Devi Tara Barrie-Hull Ramakumar & Sailaja Kosuru Christian Langers Satya Palani Jutikadevi Raja Mogan Ramasamy Alex Ruberto Matthew Wieczork Total

Loving Ganesha Distribution Fund Manoharan Navaratnarajah

Saiva Agamas Trust Fund Matthew Wieczork

Mauritius Spiritual Park Anonymous

Mauritius Dharmasala Anonymous

Nepal Kumari Goddess Education Fund Jutikadevi Raja Niraj Thaker Total

Thank You Gurudeva Fund William Raymond Atwood Maria Cristina Berisso Aravindraj Chandrasekaran Stephanie Corgatelli Chellappa Deva Amarnath Devarmanai Panshula Ganeshan George Keoki Gosselin Toshadeva Guhan Laurie Ho Rani Kellum Ganesh Krishnan Appasamy Kuppusamy Christian Langers Gregg Lien Chandran Nagalingam Eesan Sankara Sivakumar Saravan Raghuraman Srinivasan Vignesh Sukumaran Vayudeva Varadan K.D. & A.D. Williams Roy Eugene Woodward Total

Saivite Hindu Scriptural for the Blind Damara Shanmugan

Manitha Neyam Trust Fund James A. Babson N. Balasubramaniam Bala Sivaceyon Total

Kapaleeshwara Temple Fund Vasudevan Jayanthi Vellore B. Padmavathy Total

Taos Hanuman Fund Charlette A Smith

Pazhassi Balamandiram Orphanage Fund Niraj Thaker

Positive Discipline Education Fund Vinaya Alahan

Suntheram Family Trust Fund Devagharan Nair

Kauai Aadheenam Renovation Endowment Chandran Nagalingam

Gowri Nadason Satya Palani Barathy Sockanathan Total

Total Contributions

Funds at Market Value April 30, 2001

Total Endowment Funds

Total Pooled Income Funds

Grand Total |

500.00 210.00 710.00

10.00 216.00 4,000.00 50.00 25.00 46.00 20,217.58 24,564.58

54.17

381.23 160.00 90.00 35.66 55.26 102.90 50.00 659.85 178.87 14.26 21.43 62.37 50.00 49.04 100.00 132.00 21.40 65.00 92.72 10.70 521.00 104.00 49.93 102.00 104.44 42.00 10.00 108.00 84.00 134.00 177.54 75.72 108.36 63.00 248.32 4,457.00

1,100.00 12.86 48.14 1,282.05 24.00 45.62 2,512.69

15.00 100.00 52.50 167.50

90.00 210.00 36.00 60.00 396.00

100.00 51.00 151.00

15.00 35.08

210.00

100.00 30.00 50.00 180.00

100.00

156.10 25.00 103.00 20.00 100.00 8.00 108.00 50.00 30.00 150.00 750.10

50.00

35.00

281.50

281.50

108.00 57.00 165.00

50.00 50.00 11.00 200.00 25.00 216.00 20.00 20.00 20.16 100.00 20.00 101.00 19.35 150.00 4,000.00 210.00 301.00 150.00 5,000.00 108.00 75.00 108.36 2.00 11,380.87

100.00

100.00 500.00 11.82 611.82

200.00 150.00 350.00

25.00

10.00

85.00

1,500.00

210.00

29.85 50.00 20.00 99.85

$49,473.66

$3,251,964.88

$180,311.57

$3,432,276.45 |

MISSION STATEMENT

Hindu Heritage Endowment is a publicly supported, charitable organization recognized as tax exempt by the IRS on April 22, 1994. Employer ID 99-0308924. Founded by Satguru Sivaya Subramuniyaswami, its philanthropic mission is to provide secure, professionally managed financial support for institutions and religious leaders of all lineages of Sanatana Dharma.

PROFESSIONAL ADVISORS

Halbert/Hargrove, Investment Counsel; Sonoda & Isara, LLP, CPA. HHE is a member of the Council on Foundations, an association of more than 2,000 foundations which interprets relevant law and management and investment principles, and of the National Committee on Planned Giving, the voice and professional resource for the gift planning community.

I want to participate. Where should I Send My Donation?

You may send your gift to an existing fund, create a new Endowment or request information through the address below.

Donations may be made online at www.hheonline.org or use the HHE tear-out card in the HINDUISM TODAY magazine to join our family of benefactors who are Strengthening Hinduism Worldwide. Thank you.

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs