|

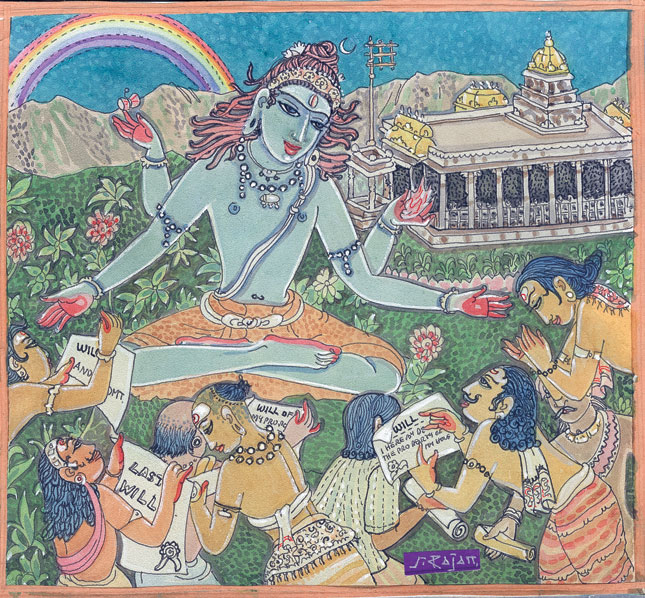

Planned Giving Newsletter

November 2020 Do you have questions about estate planning? Planned giving? Your will? Each month, we feature new articles and interactive features. We also share news about the charitable endowments under the umbrella of Hindu Heritage Endowment. The India Hindu Tribals Endowment, fund #69, provides funds to support schools in rural and tribal India Read more..."2 Smart Ways to Use Your Retirement Plan AssetsWhile a retirement plan is an excellent vehicle for accumulating assets for your use during retirement, much to many people’s surprise, it is a far less attractive way to pass an inheritance to loved ones. When you leave your retirement plan assets to loved ones, distributions will be subject to income taxes. That percentage can be even higher if your estate is subject to estate taxes. For example, if a person with a relatively small estate dies and leaves her daughter $100,000 in a retirement account, any distributions the daughter receives will be taxed at her ordinary income tax rate. A better alternative for family members is to pass on income tax–free inheritances, such as real estate, cash and life insurance. Then, use retirement plan assets to help your favorite charitable causes, which receive these assets free of taxes. Here are two ways you can use your retirement plan assets to their fullest potential: 1. If you would like extra income:By funding a charitable remainder trust with retirement plan assets, we both benefit. The trust makes payments to one or more loved ones for life or a term of years. Then, upon the trust’s termination, the balance supports Hindu Heritage Endowment. The portion projected to go toward Hindu Heritage Endowment passes free of federal estate taxes. 2. If extra income isn’t necessary:You can designate Hindu Heritage Endowment as the beneficiary of all or a portion of your retirement plan assets. We will pay no income tax, and the assets will pass to us estate tax–free, giving Hindu Heritage Endowment 100 cents on the dollar. To complete your gift, simply ask your plan administrator for a change-of-beneficiary form. 57% The number of Americans aged 30 and older who don’t know the tax effects on their retirement accounts when they name a loved one as beneficiary.

Source: “2009 Stelter Donor Insight Report”

© The Stelter Company: The information in this publication is not intended as legal advice. For legal advice, please consult an attorney. Figures cited in examples are for hypothetical purposes only and are subject to change. References to estate and income taxes include federal taxes only. State income/estate taxes or state law may impact your results.

|

Hindu Heritage Endowment | 107 Kaholalele Road | Kapaa, HI | 96746 | USA

www.hheonline.org | 808-822-3012 ext. 6 | Unsubscribe | E-mail : hhe@hindu.org | Donate