|

What is planned giving? A planned gift can be any kind of gift, large or small, and can be for any purpose. While gifts of cash are the largest source of charitable gifts, planned gifts are typically not outright cash gifts. Rather, they are sizeable asset gifts, such as life insurance, real estate, stocks and bonds or mutual funds to be used in the future. Charitable remainder trusts, gift annuities and other gift-planning arrangements are regularly funded using assets other than cash. Another definition of planned giving is the process of making a charitable gift of estate assets to one or more nonprofit organizations, such as Hindu Heritage Endowment. The most common example of a planned gift is through a will. A revocable Living Trust resembles a will, and setting it up is more involved, but it may have advantages for some people. Another example is a charitable remainder trust. During the life of a person, he or another person receives an income from the trust and then the remaining assets would go to one or more charities. In 2005 the Iraivan Hindu Temple Fund, HHE fund #2, received over US$1.3 million from a charitable remainder trust. Life insurance policies provide the means by which a donor can make a large charitable gift at a modest out-of-pocket cost. There are three ways to give through life insurance: (1) the charity is the beneficiary of the policy; (2) the charity is the owner and beneficiary of the policy; and (3) the life insurance policy is a replacement for donated assets. Several HHE endowments are beneficiaries of life insurance policies. A popular deferred gift is the charitable gift annuity, which is a lifetime contract between the donor and the charity. It is relatively simple to understand and establish. The donor can also name someone else as the annuitant to receive the annuity payments. The donor gives a gift, $50,000 for example, and receives a set amount of money every year for the rest of his or her life. Some planned gifts, such as a charitable gift annuity, are irrevocable. Others, such as will bequests, can be revoked. Depending on the country of the donor, an irrevocable gift can generate an immediate income tax charitable deduction, whereas revocable gifts do not. A planned gift requires careful thought on the part of the donor, considering his or her overall estate plan. Legal documents, created with the help of planned giving professionals, are often required. Planned gifts are usually arranged now and fulfilled later. There are numerous professional advisors in the charitable gift-planning field: certified financial planners; estate planning attorneys; life insurance professionals; certified public accountants and trust officers. In the USA, the Partnership for Philanthropic Planning is the primary association linking planned giving officers and allied professionals, with more than 108 planned giving councils represent 10,000 members. For the council nearest you call 317-269-6274 or visit www. pppnet.org. In Canada the Canadian Association of Gift Planners represents 1,100+ gift planners throughout the country. Their website is www.cagp-acpdp.org. The Charities Aid Foundation in the UK is committed to helping donors give in a tax-efficient and easy way. Visit their website at www.cafonline.org/individual/ and download their guide to savvy charitable giving. CAF also has offices in Canada, India, Australia, Bulgaria, Russia, Southern Africa and the USA. New to planned giving and want to learn more? Please visit HHE’s planned giving link at plannedgiving.hheonline.org. Here you can read all about providing the security you seek from your investments while eventually providing much-needed gifts to one or more of the 75 HHE endowments and their charities. To download an Estate Planning Tool Kit visit http://www.hheonline.org/tool-kit.shtml. |

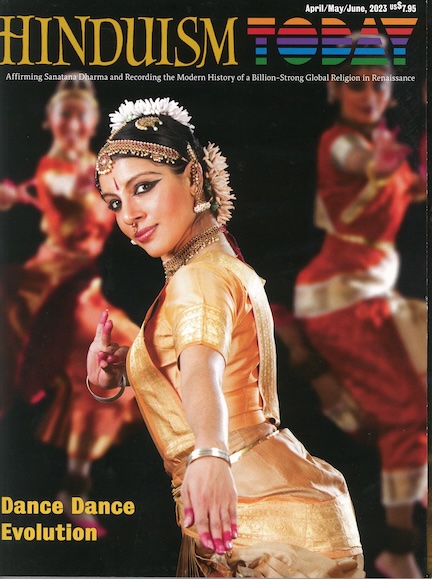

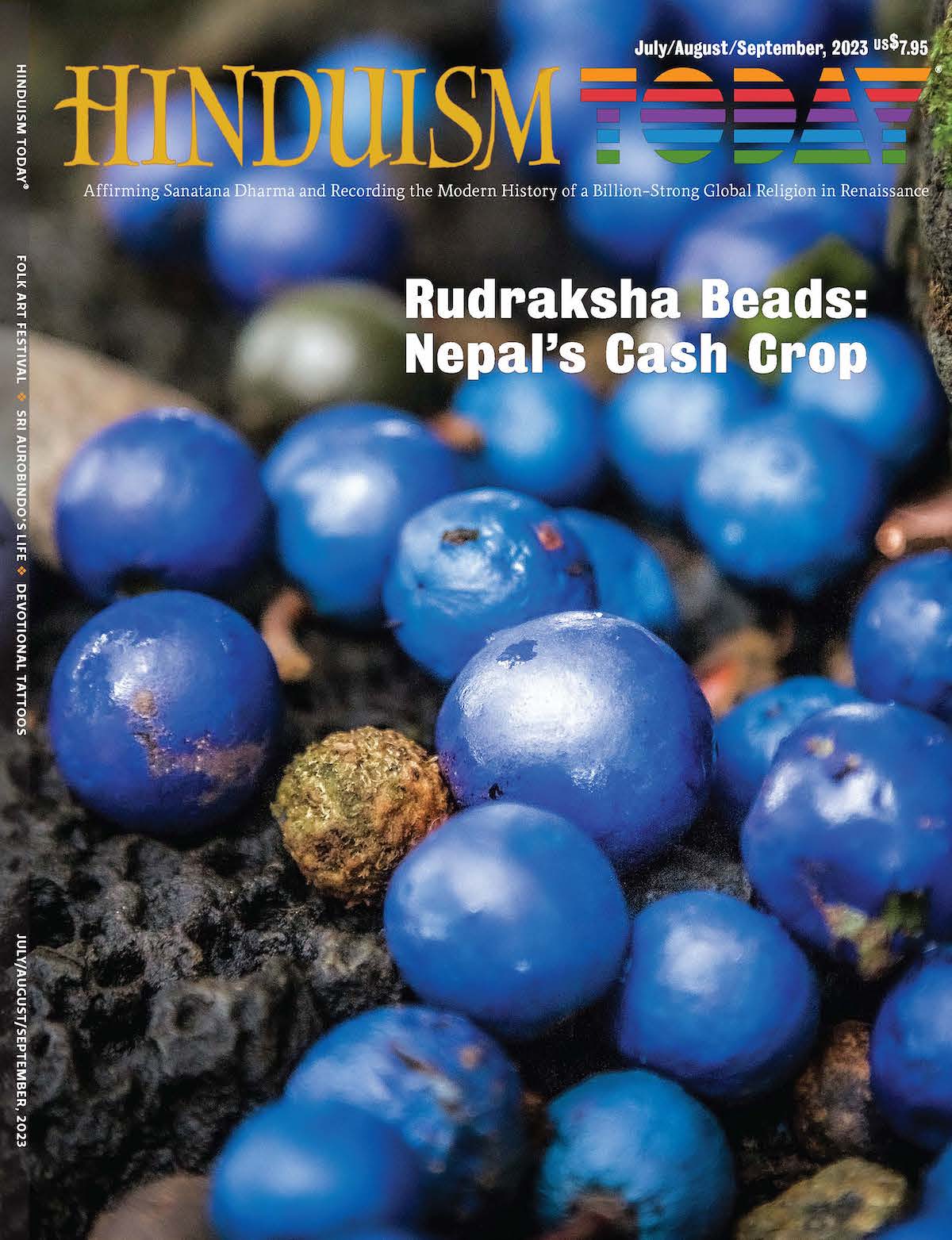

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs