HINDU HERITAGE ENDOWMENTCHARITABLE GIVING POLICIES AND PROCEDURESINTRODUCTIONThe following policies and procedures were adopted by the Board of Trustees of the Hindu Heritage Endowment (HHE) at a duly held Board meeting on June 10, 2019. These guidelines are effective as of the date of adoption. HHE is a Hawaii nonprofit public benefit trust that has been recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code of 1986, and that has been classified by the IRS as a non-private trust. These policies and procedures are applicable until modified by resolution of the trustees or until HHE’s tax status, as described above, changes. These policies and procedures are set forth in two sections. The first section describes HHE’s policies and procedures in accepting gifts from donors (these procedures do not address grants from other charities). The second section describes some issues of relevance to a donor seeking a charitable income tax deduction in the USA. SECTION ONE: POLICIES AND PROCEDURES I. Conduct towards DonorsHHE encourages gifts through the generosity of donors to further the work of HHE as well as to meet the needs of donors. HHE shall strive to provide appropriate information to donors and their advisors and shall seek to meet the needs of donors without pressure or undue influence, maintaining the highest ethical standards in all transactions. HHE shall not give legal or financial advice to anyone and shall strongly encourage prospective donors to seek their own professional counsel. When communicating with prospective donors, HHE may provide information regarding the benefits and limitations with respect to making a gift. HHE shall exercise caution in encouraging prospective donors to take action and in providing prospective donors with income projections for specific planned giving vehicles such as charitable remainder trusts. In encouraging and assisting donors with planned gifts, HHE shall follow the Model Standards for the Charitable Gift Planner approved by the National Committee on Planned Giving found in Exhibit C of these Guidelines. HHE shall hold in strict confidence all information regarding donors and prospective donors. Information regarding the donor’s identity, amount, and description of the gift, and special conditions governing the use of the gift shall not be made public if a donor so requests. HHE may provide prospective donors with a copy of these policies and procedures, including the exhibits, for consideration of the donor and the donor’s advisors. Exhibit A to these policies and procedures sets forth a chart describing the relative tax deduction for donations of certain types of property to a publicly supported charity. This Exhibit reflects the law as of the date of the adoption of these policies and procedures and, unless indicated on the Exhibit, has not been updated. It is the responsibility of the donor to determine the donor’s tax consequences related to the donation. II. Decision-Making ProcessThe Charitable Funds Manager (CFM) of HHE shall be responsible for ensuring that all gifts received are accepted in accordance with these policies and procedures. Outside advisors shall be used when appropriate. The CFM may accept gifts of cash and marketable securities. Gifts of all other assets shall be reviewed and accepted upon approval of the Board of Trustees. III. Fees and DocumentsHHE will not pay or reimburse fees generated by a donor’s legal counsel. HHE will not prepare documents relative to a donor’s estate plan. HHE shall not pay finder’s fees relating to charitable gifts. HHE will typically not pay for the costs associated with implementing a donor’s gift, other than fees to advisors retained by HHE. Donors will pay for their own appraisals. HHE may pay for its own due diligence costs, including the cost of title reports and environmental studies related to real estate gifts. IV. Acceptable Asset TypesHHE is authorized to accept the following assets:

V. Gift VehiclesHHE will accept gifts through the following gift vehicles: HHE does not offer the following gift vehicles: In order to assist donors in claiming a proper charitable deduction on their income tax returns, HHE will provide receipts to donors, as described in this Section A. IRC Section 170(f)(8) denies an income tax charitable contribution deduction for a contribution of $250 or more unless the taxpayer obtains a contemporaneous written acknowledgment from the charity. Note that, legally, it is the donor’s responsibility to obtain the receipt. The receipt must include: Contemporaneous means received on or before the earlier of the date the taxpayer files his/her tax return for the year, or the due date for the return, including extensions. B. Return Benefits to Donors HHE’s policy is not to provide any tangible benefits to donors in exchange for their contributions. HHE may change that policy by amending these policies and procedures, after consulting legal counsel. C. HHE’s Sale of Donated PropertyIn the event that HHE sells, exchanges, or otherwise disposes of “charitable contribution property” within two years of receipt, it shall file a Form 8282 with the IRS, disclosing the disposition and amount received. Charitable contribution property means property for which an income tax deduction was claimed in excess of $5,000 (except publicly traded securities). HHE’s accounting entry for donated property: receipts for gifts in kind need a corresponding entry in the general ledger. SECTION TWO: ISSUES AFFECTING DONOR DEDUCTIONS This Section does not reflect HHE policies, but is designed to be a reference to HHE staff on the basic laws and regulations that govern charitable giving. Care should be taken to keep this information up to date. HHE staff may, from time to time, provide copies of this policy to a donor for use by the donor’s advisors. Therefore, it contains some legal citations to assist donor’s counsel. By providing this information to donors, HHE is NOT advising donors on the tax or other legal consequences of a donation to HHE. All donors reading this policy are urged to consult with their own tax and legal advisors. I. Has the Donor Made a Deductible Gift?The Supreme Court held that the test for determining whether a transfer was a gift or not was whether the transfer was made out of "detached and disinterested generosity;" i.e., a transfer for no consideration and without the expectation of return benefit. Duberstein v. Comm'r ., 363 US 278 (1960). Regulation Section 1.170A-1(h) places a burden of proof on a donor who makes a gift and receives goods or services in return: In order to claim a deduction, the donor must show that his/her contribution exceeded the value of the goods or services received, and also that he/she intended to make the excess payment. Only the excess is deductible. There are also special bargain sales rules where a donor contributes property that is subject to debt, and the charity assumes the debt. In these situations, the donor’s gift will be a part gift and part sale, with basis allocations described in the IRC and Regulations. Regulation Section 1.170A-1(b): Regulation Section 1.170A-1(b) says a contribution is made at the time delivery of the gift asset is effected. The general application of this rule often involves the question: “When did the donor relinquish dominion and control over the gift asset?” B. Applications of the Basic Rules1. Gift by check or credit card The unconditional delivery of a check which clears in “due course” is deemed to be given on date of delivery to HHE. A contribution made by credit card is deductible in the year in which the charge is made, regardless of when paid. Rev. Rul. 78-38, 1978-1 CB 67. 2. Gift of stock A properly endorsed stock certificate (or stock certificate and signed stock power) donated to a charity (or its agent) is deemed given on date of delivery. Alternative rule: The gift is complete when ownership of the stock is transferred on the corporation’s books and records. For shares held in street name, the gift is complete when ownership of the stock is changed on the broker’s records. 3. When is a check or stock certificate “delivered” the “mailbox” rule A check (or stock certificate) that is mailed to HHE, and received in due course, is deemed to be delivered on date of mailing. It is not clear whether this longstanding “mailbox rule” applies to checks or certificates sent by Federal Express or other private carrier. When a donor puts a letter in a USPS mailbox, or when a letter is taken from a donor’s private mailbox by a postal worker, the donor can no longer take back the letter. The letter no longer belongs to the donor. On the other hand, when a donor sends a Federal Express envelope, Federal Express is the donor’s agent, and the donor can theoretically ask Federal Express not to deliver the package. In that case, the date of delivery is the date that the package is received by HHE. 4. Real property and tangible personal property Delivery of tangible personal property usually requires an actual transfer of possession. In some cases, constructive delivery can be shown (TG Murphy, TC Memo 1991-276), for example, by delivery of a signed bill of sale. Gifts of real estate require the delivery of a formally executed and acknowledged (notarized) deed. Regulation Section 1.170A-13 contains a wealth of useful information. Note that these rules apply to all gifts, regardless of whether the substantiation rules of IRC Section 170(f)(8) apply. B. The “Basic” Rules for Gifts of Cash and PropertyFor gifts of cash, the donor must maintain a canceled check, receipt, or other “reliable written records” evidencing each contribution (including name of charity, date, and amount). The burden of proof regarding the “reliability” of those records (i.e., whether the IRS will accept them) rests with the donor. For gifts of property to which the appraisal rules (described below) do not apply, the donor must maintain a receipt from the charity showing the name of the charity, the date and location of the gift, and a description (but not value) of the property. If the deduction for a gift of property exceeds $500, the donor must maintain a written record including the above information plus manner and date of acquisition and cost basis, and the donor must complete and submit Form 8283 with the donor’s return. Appraisal rules are discussed below. For a discussion of receipts that HHE should provide to the donor, see Section One, Part V, above. IV. Appraisals One of the requirements for gifts that include items other than cash, cash equivalents, or publicly traded stock with no restrictions as to transfer, is that these gifts, if worth more than $5,000, must be appraised. The following rules apply to appraisals, for which the donor is responsible. A. Qualified Appraisal To be a qualified appraisal, a document must:

A qualified appraisal must include the following information:

B. Qualified Appraiser

A qualified appraiser is an individual who meets the following criteria: a ) Holds himself or herself out to the public as an appraiser or performs appraisals on a regular basis; b) Is qualified to make appraisals of the type of property being valued, according to qualifications described in the appraisal; c) Understands that an intentional overstatement of the value of the property described in the appraisal may subject the appraiser to civil penalty for aiding and abetting an understatement of tax liability; d) Is not the donor, donee, or any party to the transaction in which the donor acquired the property; e) Is not any person employed by or related to one of the above parties; and f) Is not someone primarily used by one of the above parties who does not perform a majority of his or her appraisals for other persons. C. Appraisal SummaryIn addition to obtaining a qualified appraisal, the donor must attach an “appraisal summary,” which must be signed by both the appraiser and the donee, to his/her income tax return for the year in which the deduction is claimed. The IRS has provided Form 8283 for this purpose. V. Sample FormThe following is an all-purpose receipt where no return benefits are provided to donor. This letter is to gratefully acknowledge, for your tax records, our receipt of your generous gift of [cash in the amount of $_______] [describe property donated in reasonable detail]. We received your gift on [date] at [location]. No goods or services were provided to you in exchange for this gift. Therefore, the full amount of your contribution is deductible. Again, we thank you for your support. EXHIBIT A LIMITATIONS ON CHARITABLE CONTRIBUTIONS INCOME TAX DEDUCTIONS

NOTES EXHIBIT B REAL ESTATE INFORMATION QUESTIONNAIRE

EXHIBIT C MODEL STANDARDS OF PRACTICE FOR THE CHARITABLE GIFT PLANNER PREAMBLEThe purpose of this statement is to encourage responsible gift planning by urging the adoption of the following Standards of Practice by all individuals who work in the charitable gift planning process, gift planning officers, fund raising consultants, attorneys, accountants, financial planners, life insurance agents and other financial services professionals (collectively referred to hereafter as "Gift Planners"), and by the institutions that these persons represent. This statement recognizes that the solicitation, planning and administration of a charitable gift is a complex process involving philanthropic, personal, financial, and tax considerations, and as such often involves professionals from various disciplines whose goals should include working together to structure a gift that achieves a fair and proper balance between the interests of the donor and the purposes of the charitable institution. I. PRIMACY OF PHILANTHROPIC MOTIVATIONThe principal basis for making a charitable gift should be a desire on the part of the donor to support the work of charitable institutions. II. EXPLANATION OF TAX IMPLICATIONSCongress has provided tax incentives for charitable giving, and the emphasis in this statement on philanthropic motivation in no way minimizes the necessity and appropriateness of a full and accurate explanation by the Gift Planner of those incentives and their implications. III. FULL DISCLOSUREIt is essential to the gift planning process that the role and relationships of all parties involved, including how and by whom each is compensated, be fully disclosed to the donor. A Gift Planner shall not act or purport to act as a representative of any charity without the express knowledge and approval of the charity, and shall not, while employed by the charity, act or purport to act as a representative of the donor, without the express consent of both the charity and the donor. IV. COMPENSATIONCompensation paid to Gift Planners shall be reasonable and proportionate to the services provided. Payment of finders fees, commissions or other fees by a donee organization to an independent Gift Planner as a condition for the delivery of a gift are never appropriate. Such payments lead to abusive practices and may violate certain state and federal regulations. Likewise, commission-based compensation for Gift Planners who are employed by a charitable institution is never appropriate. V. COMPETENCE AND PROFESSIONALISMThe Gift Planner should strive to achieve and maintain a high degree of competence in his or her chosen area, and shall advise donors only in areas in which he or she is professionally qualified. It is a hallmark of professionalism for Gift Planners that they realize when they have reached the limits of their knowledge and expertise, and as a result, should include other professionals in the process. Such relationships should be characterized by courtesy, tact and mutual respect. VI. CONSULTATION WITH INDEPENDENT ADVISORSA Gift Planner acting on behalf of a charity shall in all cases strongly encourage the donor to discuss the proposed gift with competent independent legal and tax advisors of the donor's choice. VII. CONSULTATION WITH CHARITIESAlthough Gift Planners frequently and properly counsel donors concerning specific charitable gifts without the prior knowledge or approval of the donee organization, the Gift Planners, in order to insure that the gift will accomplish the donor's objectives, should encourage the donor, early in the gift planning process, to discuss the proposed gift with the charity to whom the gift is to be made. In cases where the donor desires anonymity, the Gift Planners shall endeavor, on behalf of the undisclosed donor, to obtain the charity's input in the gift planning process. VIII. DESCRIPTION AND REPRESENTATION OF GIFTThe Gift Planner shall make every effort to assure that the donor receives a full description and an accurate representation of all aspects of any proposed charitable gift plan. The consequences for the charity, the donor and, where applicable, the donor's family, should be apparent, and the assumptions underlying any financial illustrations should be realistic. IX. FULL COMPLIANCEA Gift Planner shall fully comply with and shall encourage other parties in the gift planning process to fully comply with both the letter and spirit of all applicable federal and state laws and regulations. X. PUBLIC TRUSTGift Planners shall, in all dealings with donors, institutions and other professionals, act with fairness, honesty, integrity and openness. Except for compensation received for services, the terms of which have been disclosed to the donor, they shall have no vested interest that could result in personal gain. Adopted and subscribed to by the National Committee on Planned Giving and the American Council on Gift Annuities, May 7, 1991. Revised April 1999. |

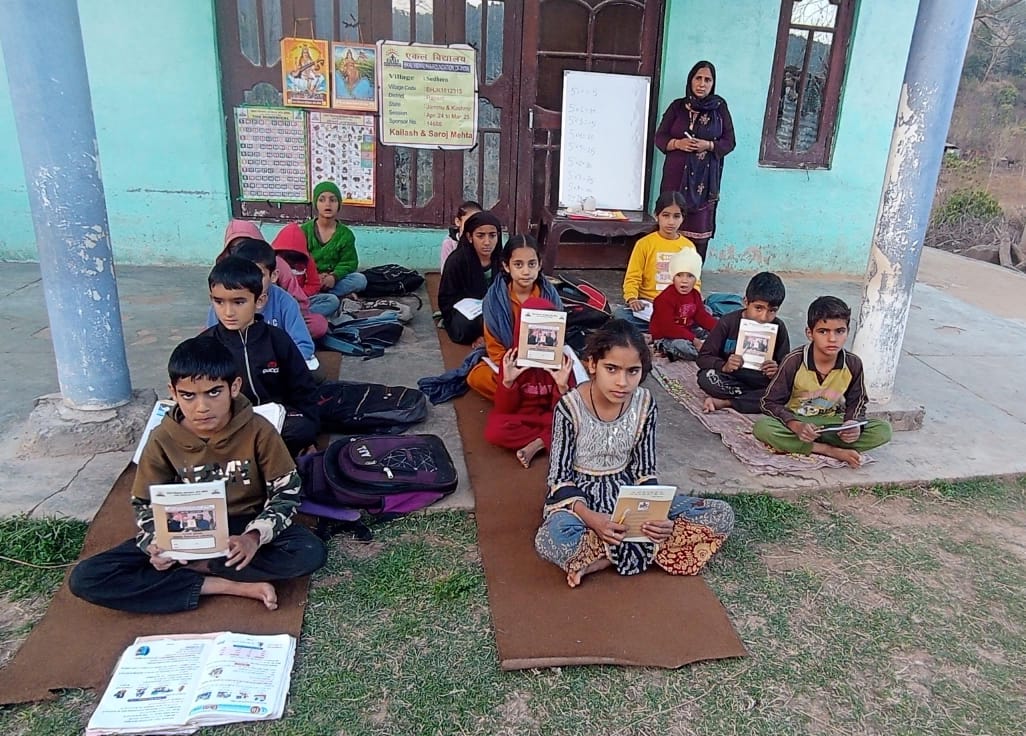

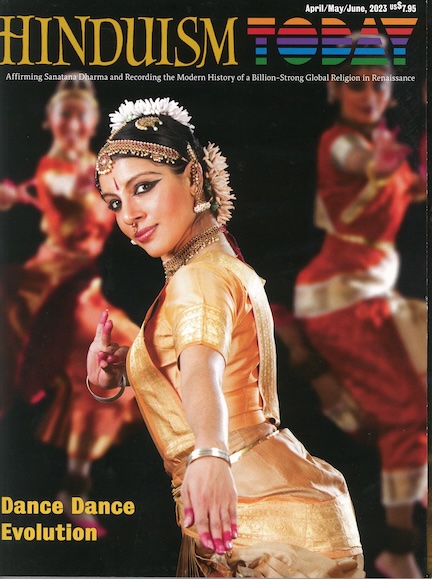

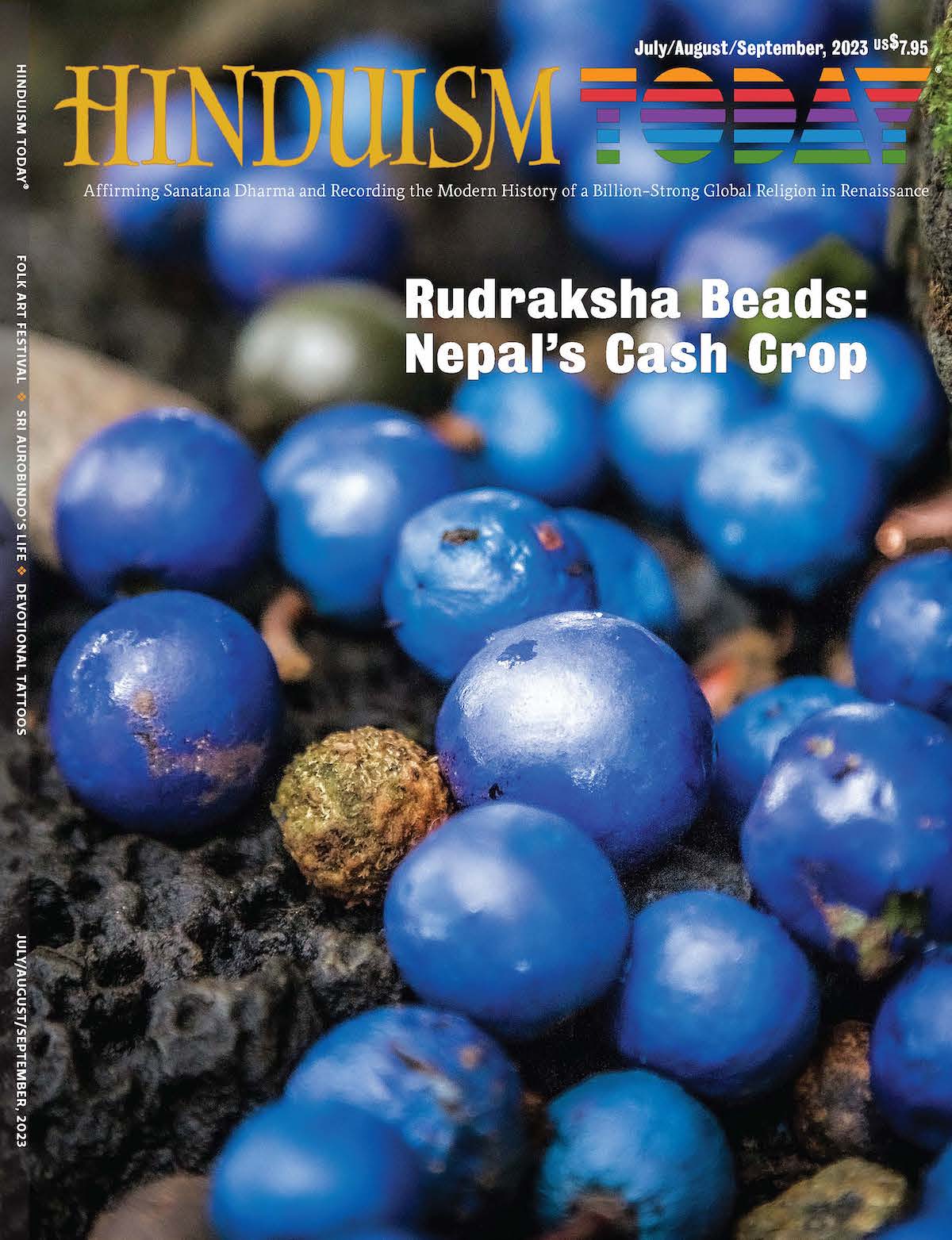

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs