HHE Funds—Like Popular Donor-Advised Funds—Are Attuned to Donors Interest, but There’s More …The surging popularity of donor-advised funds, a charitable tool virtually non-existent 30 years ago, has recently caught the attention of the for-profit world. In the meantime, the Hindu Heritage Endowment (HHE) has been quietly offering a similar service since 1994.  These specialized funds provide donors with the tax benefits of a public charity while allowing them to decide which charities they wish to benefit and when. Donor-advised funds have some of the features of a private foundation, but without the high management costs, paperwork, less favorable tax treatment and the multi-million-dollar contributions private foundations often require. For as little as $5,000, a donor can quickly establish his or her fund under the tax umbrella of a public charity. But which public charity? To the dismay of community foundations that had offered donor-advised funds for years, Fidelity, Vanguard, Schwab and other big investment firms have set up charitable entities that give the same tax benefits offered at community foundations: an immediate income-tax deduction, bypass of capital gains tax on contributions of appreciated stock and estate tax avoidance. A December, 2007, article in the Business Section of the San Francisco Chronicle gave major space to donor-advised funds, pointing out their convenience, flexibility and popularity. The article noted that Fidelity Investments alone now has $4.7 billion in donor-advised funds under its management. It is estimated that more than 100,000 donor-advised funds exist in the United States, with a total value of $17.5 billion. The breathless end-of-year donor in search of a charitable deduction, but uncertain of whom to benefit, can reap the tax advantages quickly, and then calmly decide over time what charities should receive the income or principal from the fund. Some donors also like having a permanent fund in the family as a tool for passing the philanthropic torch to their children. Community foundations argue that large investment firms, lacking their knowledge of the local community, cannot assist donors to find charities attuned to their interests. The investment firms claim their clients are self-starters who don’t need such guidance and who want to research charities on their own. HHE believes it has found a niche that neither investment firms nor community foundations can fill. “Many of the donors want their contributions to help causes in India, Sri Lanka or other places overseas,” HHE administrator Shanmuganathaswami explains. “The HHE staff knows how to make sure these contributions to Hindu causes will be fully tax-deductible and how to monitor their use for charitable purposes. Most HHE donors simply name the cause they want to support when they create their fund, rather than give annual instructions.” Gurudeva established the Hindu Heritage Endowment because he felt all Hindu causes should have the benefits of a steady income from a well-managed endowment. Contributions to HHE bring no financial benefit to Kauai’s Hindu Monastery, unless the donor so designates. The monks have retained Halbert, Hargrove/Russell (HHR) Investment Council to manage the endowment’s investments. HHE encourages Hindu temples and other charities to take advantage of HHR’s investment expertise. Income from several HHE endowments now largely supports the Kauai monastery. At formal quarterly meetings the monks review the investment performance of HHE funds with the concentrated attention they bring to meditation. “We claim no professional investment expertise, but we understand numbers and take our oversight responsibilities very seriously,” Shanmuganathaswami explains. For information on establishing a fund at the Hindu Heritage Endowment, contact Sannyasin Shanmuganathaswami at 808-822-3012 or e-mail hhe@hindu.org. Donate to the endowment funds at www.hheonline.org |

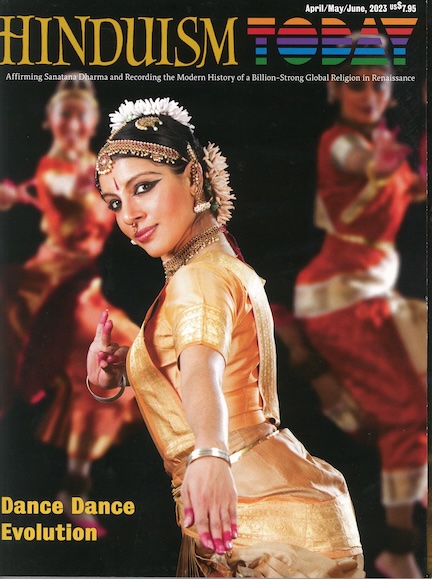

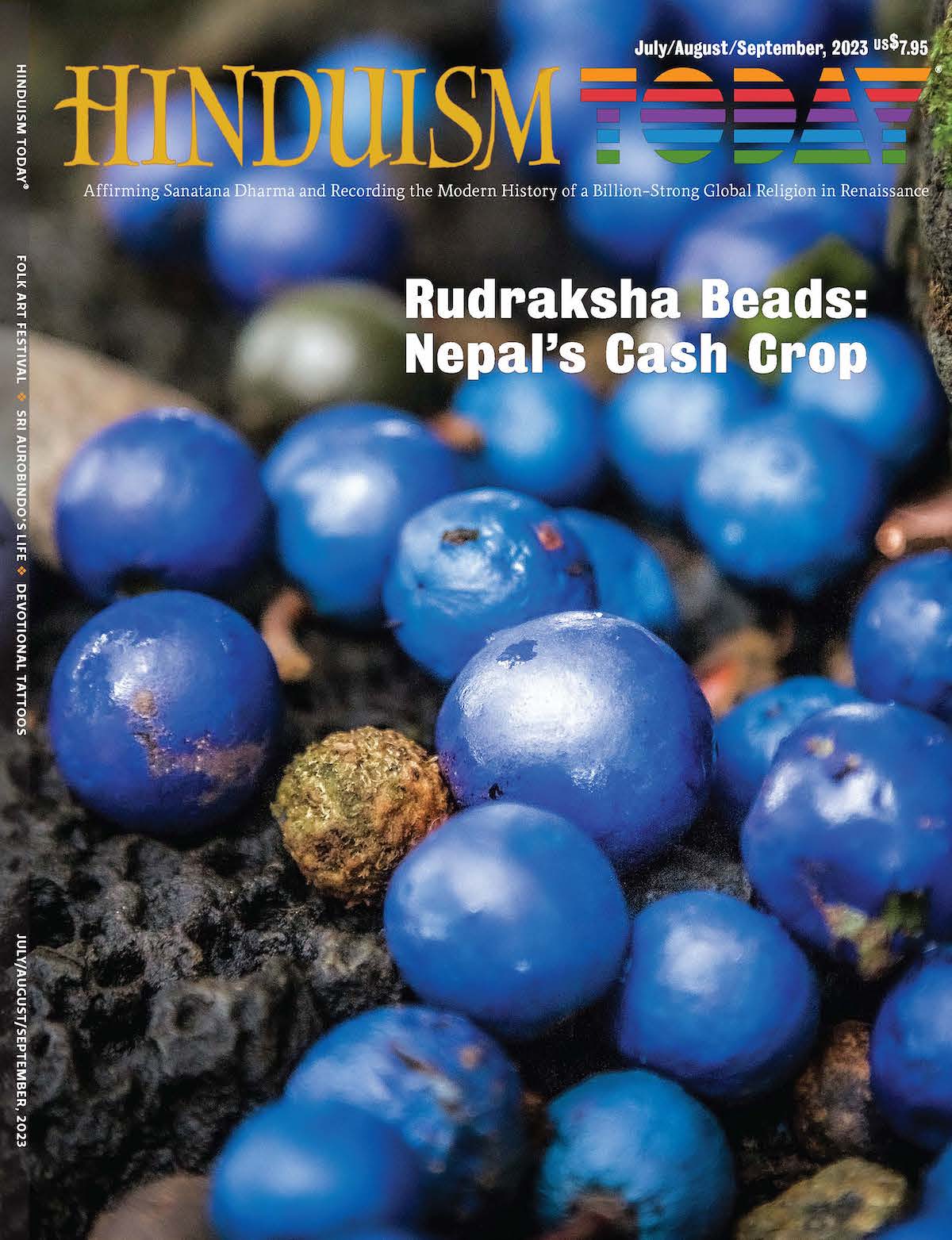

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs