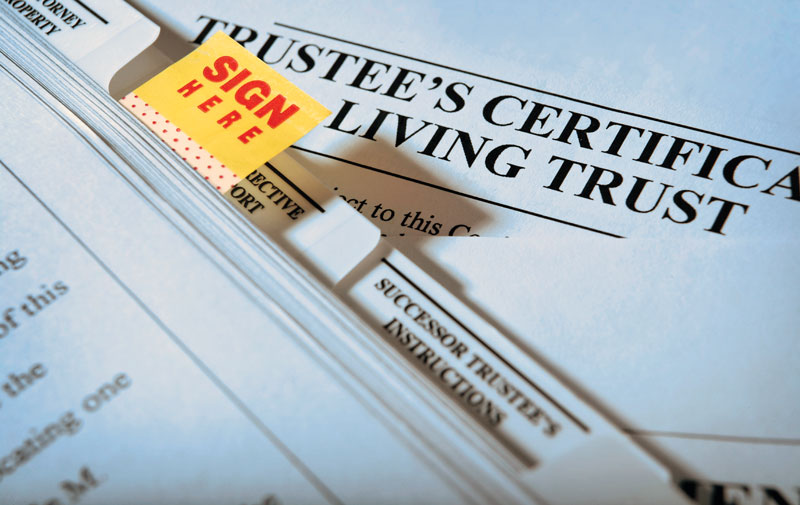

Ways of Giving that Don't Tax Your Finances

Besides the will, there are many branches on the tree of giving, including insurance, payable on death, pooled income funds, living trusts and individual retirement accounts.

When the Hindu Heritage Endowment staged its first-ever estate planning seminar last August in Walnut Creek, California, the fissures in the global economy were beginning to show in higher energy and food prices. The seminar, however, focused on a strategy that works in good times and bad: protection from taxes, court costs and legal fees through sound estate planning. With the economic meltdown, the Hindu Heritage Endowment is following a similar tack by encouraging ways of giving that allow donors to remain generous while not further taxing their battered finances. Here are some examples. A 45-year-old marketing executive saw his IRA take a big hit in 2008. Still, he said, “I’m in this for the long run. By including the Hindu Heritage Endowment as a beneficiary of my IRA, I know that whatever the Hindu Heritage Endowment receives will be tax-free. My relatives will have to pay income tax on their share.” He added that the IRA designation is easy to do and has left his current finances unaffected. A physician in her fifties used a similar strategy with a life insurance policy. “Many people think that life insurance proceeds are not vulnerable to estate tax,” she cautioned. “They do not go through probate or get hit by income tax, but if you own the policy, it may be subject to estate tax.” She knows that any portion of her life insurance proceeds that goes to the Hindu Heritage Endowment will go free of any tax. “Besides, it was very easy to do,” she explained. “I just filled out a beneficiary designation form naming the Hindu Heritage Endowment for a percentage and mailed it to my insurance company.” The parents of three adult children have a living trust. “We wanted most of our estate to go to our children,” the father explained. “We used a residual bequest to accomplish this. It states that whatever remains after our children receive their distributions passes to the Hindu Heritage Endowment.” The three strategies above have common traits: they are tax-free, simple to do and revocable. Phil Murphy, HHE’s planned giving consultant, emphasizes the virtues of revocability in dicey economic times: “Bequests to good causes, whether through IRAs, life insurance, living trust or wills, can always be changed. We remain in control.” Murphy thinks of estate planning as one way to recover from a shaken sense of personal power. “Most of us feel a loss of control when the value of what we own suddenly changes for the worse. But we can channel that anxiety into useful action by reviewing our estate plan. That way we can make sure that those we care about will not face avoidable taxes, fees and court costs. That’s always a good idea, but especially when every penny counts.” For more information on estate planning and planned giving, visit the Hindu Heritage Endowment website and click on Planned Giving, then Essentials. Or call Shanmuganathaswami at 808-822-3012 or hhe@hindu.org.

|

Hinduism Today Lifetime Subscription Fund

Helps cover the magazine’s production and distribution costs